Finance

Merchant Cash Advance Blursoft: Rapid Business Financing

Quick access to funding can alter everything for a business owner by allowing them to take advantage of opportunities or get over obstacles with cash flow. One place for expedited financing is through Merchant Cash Advance (MCA), a specialty of companies like Blursoft.

Blursoft stands out for its seamless MCA application process. In just a few minutes, you can complete the online application, requiring minimal documentation. Their focus is on simplicity and speed.

Unlike traditional small business loans, Merchant Cash Advance Blursoft offer a significant advantage in terms of decision speed. Blursoft aims to provide applicants with a rapid decision, often within 24 hours. This swift turnaround time is crucial for businesses looking to make timely decisions.

Upon approval, businesses gain direct access to a lump sum payment, conveniently deposited into their bank accounts. This direct deposit feature ensures that the funds are readily available for immediate use, addressing urgent financial needs.

Blursoft’s Key Differences from Traditional Loans

Merchant Cash Advance deviate from conventional small business loans in several notable ways, providing unique benefits for businesses:

- No Collateral Requirement: Unlike traditional loans that often demand collateral, Merchant Cash Advance leverage future sales as the repayment mechanism. This is particularly advantageous for businesses with limited assets or those with less favorable credit histories.

- Expedited Funding Timeline: The application process for MCA is notably faster compared to traditional loans, with funds becoming available in a matter of days rather than weeks or months. This accelerated timeline is invaluable when time is of the essence.

- Flexible Repayment Structure: One of the distinctive features of Merchant Cash Advance Blursoft is the repayment structure. Instead of fixed monthly payments, repayment is tied to a percentage of daily credit card sales. This flexibility ensures that the repayment amount aligns with the business’s daily sales volumes, providing a more adaptable and manageable repayment strategy.

The Blursoft’s emphasis on a speedy application process, quick decisions, and direct deposit makes Merchant Cash Advance an attractive option for businesses seeking swift access to capital without the difficulty associated with traditional loans. The unique repayment structure further adds flexibility, aligning repayment with the natural ebb and flow of daily credit card sales.

What is Blursoft’s Merchant Cash Advance?

Blursoft operates by providing businesses with a Merchant Cash Advance (MCA), a straightforward financing solution that revolves around your daily credit card sales.

When you engage with Blursoft, they offer an initial lump sum payment. This upfront amount is tailored to your business needs and is designed to address immediate financial requirements or capitalize on opportunities.

Repayment through Daily Credit Card Sales

The repayment mechanism is tied to a percentage of your daily credit card sales. For instance, if Blursoft advances $50,000 to your business, you would reimburse them by remitting 15% of your daily credit card sales until the entire $50,000 is repaid.

The repayment period typically spans between 6 to 24 months, providing a reasonable timeframe for businesses to manage their cash flow and meet repayment obligations. This flexibility accommodates variations in business performance over time.

Customized Terms Based on Business Factors

Each advance has unique parameters, including the amount given, the percentage to be repaid, and the length of time to repay it. Blursoft considers various factors including your business’s tenure, sales volume, and credit profile when determining these terms.

The amount advanced is not a variable that works for everyone. Instead, it is determined by analyzing factors like your business’s historical performance, current sales, and immediate financial needs. This personalized approach ensures that the financing aligns with your specific circumstances.

The agreed-upon percentage for repayment is crafted with consideration for your daily credit card sales. This flexible structure allows your business to meet its financial obligations without imposing undue strain, as repayments are directly linked to your ongoing sales.

Tailored Repayment Term for Sustainability

Recognizing that businesses vary in their growth trajectories, Blursoft tailors the repayment term. Whether your business benefits from a shorter repayment cycle or requires a more extended timeframe, the terms are customized to suit the unique dynamics of your operation.

To sum up, Blursoft’s Merchant Cash Advance (MCA) process is characterized by its simplicity, flexibility, and customization. By aligning repayment with daily sales and offering personalized terms, Blursoft provides businesses with a financing solution that adapts to their specific needs and ensures a sustainable approach to repayment.

Benefits of Blursoft Merchant Cash Advance

Small business owners find several advantages in opting for merchant cash advances, especially those offered by Blursoft, making them an enticing financing option.

1. Speedy Access to Capital

Blursoft excels in providing a swift application process, ensuring that businesses can secure funds in as little as 24-48 hours. This rapid access proves invaluable for addressing urgent capital needs, setting MCA apart as an ideal solution for quick financial support.

2. Flexible Repayment Structure

Unlike traditional loans with fixed monthly payments, Merchant Cash Advance repayments adapt to the natural fluctuations in sales volumes. Structured as a percentage of daily credit card sales, this flexibility allows businesses to navigate varying revenue streams without being tied to rigid repayment schedules.

3. Accessibility for Diverse Business Profiles

Qualifying for Merchant Cash Advance Blursoft relies more on sales history than traditional metrics such as credit scores, assets, or business longevity. This inclusive approach opens up avenues for newer or distressed businesses to access capital, particularly when traditional lending options pose challenges.

4. No Collateral Requirements

Blursoft’s Merchant Cash Advance eliminate the need for collateral, distinguishing them from traditional loans. This absence of collateral barriers simplifies the process for businesses seeking funds, offering financial support without jeopardizing valuable assets.

5. Streamlined Application Process

In addition to the inherent benefits, Blursoft’s Merchant Cash Advance feature a straightforward application process. Businesses can easily apply online or over the phone, streamlining the initial steps towards securing essential capital. Funds are efficiently transferred directly to the business checking account via ACH transfer, ensuring fast and easy access.

Drawbacks of of Blursoft Merchant Cash Advance

While Blursoft’s Merchant Cash Advance offer notable advantages, it’s crucial to be aware of potential downsides to make informed decisions.

1. Higher Rates and Fees

One consideration is that Merchant Cash Advance rates and fees are generally higher compared to traditional bank loans. Businesses need to weigh the cost against the urgency of capital needs.

2. Short Repayment Terms

Repayment terms for Merchant Cash Advance typically range from 6 to 24 months. This shorter timeframe demands careful financial planning to meet obligations within the specified period.

3. Impact on Future Sales Revenue

Repayment occurs by deducting a fixed percentage from future credit card sales. While this aligns with the flexibility of sales volumes, it’s essential to consider the impact on overall revenue.

4. Limitations on Qualifying for Other Financing

Once the Blursoft Merchant Cash Advance is in place, qualifying for additional financing may become challenging. Businesses should consider the potential restrictions on seeking alternative financing during this period.

MCA Success Story: NYC Construction and Blursoft

To illustrate how companies like Blursoft facilitate Merchant Cash Advance, let’s get into the case of a small commercial construction firm named NYC Construction.

NYC Construction’s Challenge and Opportunity

NYC Construction, with three years in business, encountered a setback due to a materials cost overrun, impacting their cash reserves. Despite gearing up for operations, they faced a crucial juncture when a medium-sized commercial project, set to commence in 60 days, required $100,000 upfront for mobilizing equipment and preparing the job site. With assets tied up in equipment and lacking established banking relationships as a newer firm, NYC sought a solution to bridge the financial gap.

Turning to Blursoft’s website, NYC completed a concise online Merchant Cash Advance application. This involved providing essential details about their business, sales history, owner background, and the required funding amount. The streamlined application process aimed to minimize the time and effort required to secure financing.

Approval and Tailored Terms

Blursoft promptly reviewed NYC’s application and approved them for a $100,000 Merchant Cash Advance. The terms were established as an 18-month repayment period, with NYC committing to remit 18% of their daily credit card sales to retire the advance.

Accepting the terms, NYC witnessed the efficiency of Blursoft’s process as the approved $100,000 lump sum payment was directly deposited into their account within a mere 48 hours. This expedited access to capital was crucial for NYC’s timely preparation and mobilization ahead of the impending project.

Flexible Repayment Structure in Action

Over the subsequent 18 months, NYC diligently repaid the Merchant Cash Advance. The repayment mechanism, structured as 18% of their average daily credit card sales of $5,000, translated to $900 remitted daily to Blursoft. This flexible repayment structure aligned with the fluctuations in NYC’s daily sales volumes, ensuring a manageable and adaptable approach to meeting financial obligations.

By leveraging the Merchant Cash Advance from Blursoft, NYC Construction successfully overcame financial hurdles and secured the essential funds needed to undertake the critical commercial project. This achievement, which might have been challenging and time-consuming through traditional financing channels, propelled NYC’s business growth, underscoring the effectiveness of Blursoft Merchant Cash Advance in enabling timely and impactful opportunities.

Eligibility Criteria for a Merchant Cash Advance Blursoft

Blursoft extends Merchant Cash Advance (MCA) to businesses, offering a streamlined process for those in need of quick and accessible financing. To be eligible for a Blursoft MCA, you must satisfy the following criteria:

- Business Tenure Requirement: To qualify, your business should have a track record of at least 6 months in operation. This stipulation ensures a degree of stability and experience in your business endeavors.

- Minimum Monthly Credit Card Sales: A key factor in eligibility is a minimum monthly credit card sales threshold. Your business should demonstrate a consistent credit card sales volume, with a minimum of $5,000 per month. This criterion reflects the reliance on credit card transactions as a basis for the Merchant Cash Advance.

- Valid Business Bank Account: Having a valid business bank account is essential for the MCA process. This requirement streamlines the transfer of funds and ensures a direct and secure channel for transactions.

- Age and Citizenship Criteria: Individual eligibility criteria include being at least 18 years old and holding status as a US citizen or permanent resident. This ensures that the legal and citizenship aspects are in compliance with the necessary regulations.

Blursoft’s Merchant Cash Advance application process is designed to be straightforward, minimizing the bureaucratic hurdles associated with traditional financing. By adhering to these eligibility criteria, businesses can efficiently navigate the application process and access the financial support they need.

The eligibility criteria set by Blursoft aim to strike a balance, ensuring accessibility while maintaining a level of financial stability. Whether your business is a startup or a more established entity, meeting these criteria opens the door to leveraging Blursoft’s Merchant Cash Advance for swift and efficient financing tailored to your specific needs.

Steps to Apply for Merchant Cast Advance from Blursoft

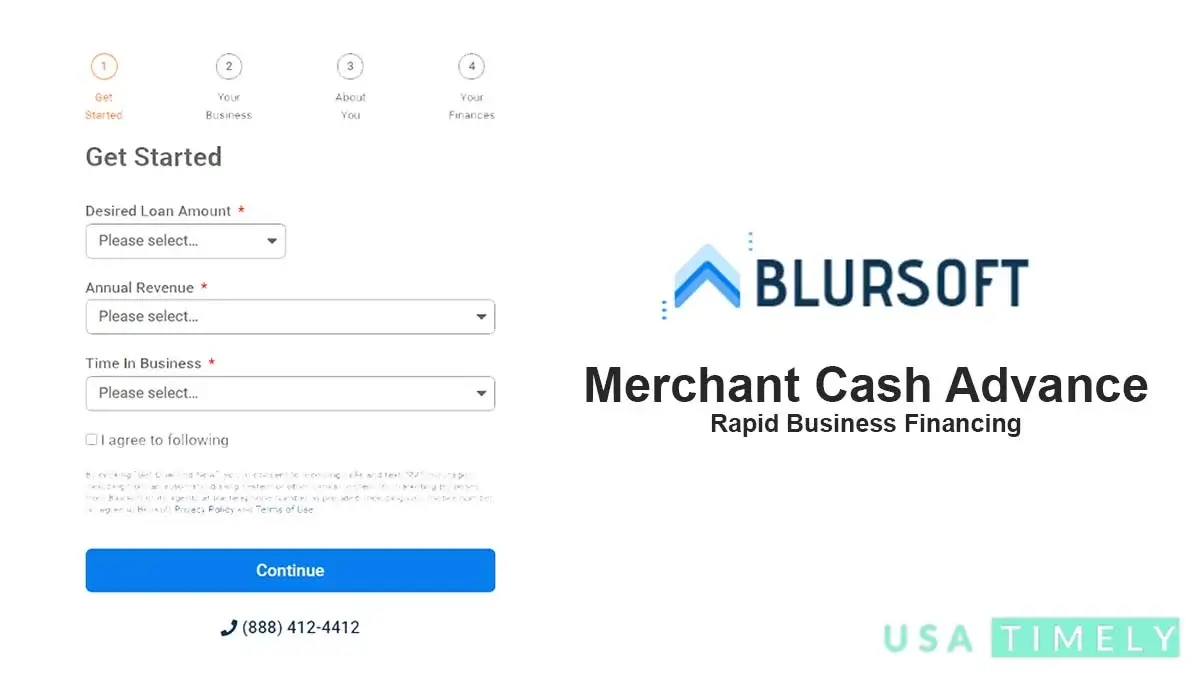

Obtaining a Merchant Cash Advance from Blursoft is a straightforward and swift process. Here’s a step-by-step guide to assist you through the application:

- Visit the Blursoft Website: Initiate the application process by navigating to the official Blursoft website. Look for the “Apply Now” button, typically prominently displayed for easy access. (Apply Form Navigation: https://blursoft.com/application/)

- Complete the Online Form: Click on “Apply Now” and fill out the online form. Provide fundamental details about your business, offering insights into your operations and outlining your funding requirements. This step ensures Blursoft gains a comprehensive understanding of your needs.

- Await Specialist Contact: After submitting your online application, anticipate a prompt response from one of Blursoft’s funding specialists. They will reach out to you to discuss your unique business circumstances and determine the most suitable Merchant Cash Advance option tailored to your requirements. (Quick Contact Number for Merchant Cash Advance Blursoft: (888) 412-4412)

- Review and Sign Agreement: Upon consultation with the funding specialist, you will receive details about the MCA option recommended for you. Take the time to thoroughly review the terms and conditions. Once satisfied, proceed to sign the agreement with Blursoft’s lending partner, solidifying the arrangement.

- Swift Cash Deposit: Upon agreement signing, Blursoft ensures a swift and efficient transfer of funds. Expect the approved cash amount to be deposited directly into your business bank account within a mere 24 hours. This expeditious process is designed to address your urgent funding needs promptly.

Blursoft’s MCA application process is user-friendly, minimizing administrative difficulties and expediting the funding journey for businesses. By following these simple steps, you can access the financial support your business requires in a timely and efficient manner.

Merchant Cash Advance Post Application Journey with Blursoft

Once you’ve successfully applied for an Merchant Cash Advance from Blursoft and received the cash from the lending partner, here’s what you can expect in the subsequent phases of your financial journey.

Immediate Utilization of Funds

Upon receipt of the funds, you gain instant flexibility to allocate the cash for your business needs. Whether it’s addressing operational expenses, seizing growth opportunities, or managing unforeseen challenges, the capital is at your disposal.

Commencement of Automatic Repayment

The repayment process kicks off seamlessly, with a fixed percentage of your daily credit card sales dedicated to retiring the Merchant Cash Advance. This automated approach eliminates the need for manual interventions and ensures an easy repayment experience.

The MCA repayment structure with Blursoft simplifies your financial commitments, as the predetermined percentage is automatically deducted from your daily credit card sales.

Online Tracking for Transparency

Blursoft enhances your financial visibility through their online portal. You can easily track your balance and monitor payments in real-time. This transparency empowers you to stay informed about your financial standing and the progress of your Merchant Cash Advance repayment.

Blursoft’s commitment to a user-friendly experience extends beyond the application phase. The post-application period is characterized by automation, transparency, and convenience, allowing you to focus on driving your business forward without the burden of complex financial management.

Blursoft Empowering Businesses with Financial Control

Applying for Merchant Cash Advance Blursoft not only provides swift access to capital but also ensures a smooth and stress-free repayment process. The integration of technology through the online portal offers businesses a level of control and transparency, empowering them to make valid financial decisions as they navigate their unique growth journeys.