Finance

What Is an Audited Financial Statement?

When you apply for business funding, lenders and investors need assurance that they won’t lose money. To provide this, you should bring detailed financial statements to your pitch meeting. However, if they still feel uncertain about your company’s finances, it might be because you haven’t prepared an audited financial statement. Here, we’ll explain what an audited financial statement is and how it differs from an unaudited financial statement.

What is an Audited Financial Statement?

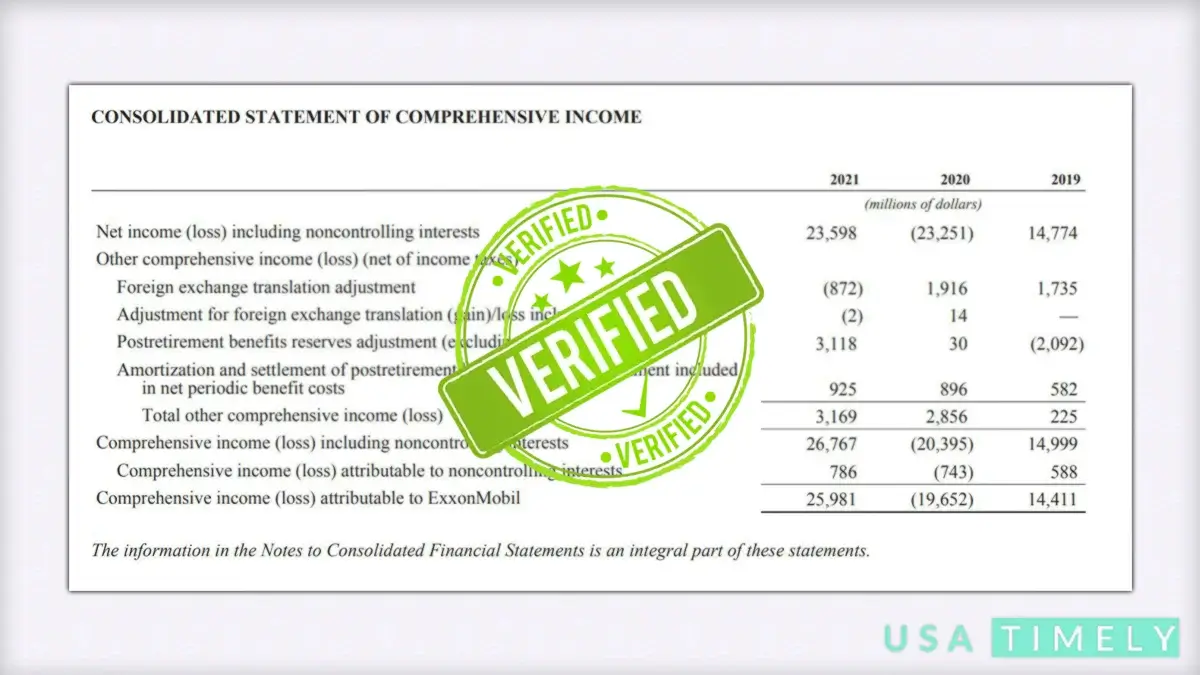

An audited financial statement is a financial statement that a certified public accountant (CPA) has examined. When a CPA audits a financial statement, they check that it follows general accounting principles and auditing standards. Without this verification, investors and lenders may doubt the accuracy of the statement you’re presenting.

Different Types of Audited Financial Statements

There are four main types of financial statements that may require auditing:

- Balance Sheet: This document outlines your business’s total assets, shareholder equity, and debts at a specific point in time. Think of it as a snapshot of your company’s financial status.

- Cash Flow Statement: This statement shows the movement of cash and cash equivalents in and out of your company’s bank accounts. Cash equivalents include overdrafts, bank deposits, cash-convertible assets, and short-term investments. Cash here refers to both available cash and money in demand deposits.

- Income Statement: Also known as a profit and loss statement, this document details your company’s revenue after deducting all expenses and losses. Unlike the balance sheet, which is a snapshot, the income statement covers a period of time. It includes metrics like gross profits, net earnings, revenue, expenses, cost of goods sold, taxes, and pretax earnings.

- Statement of Shareholder Equity: While often part of the balance sheet, this statement can also be prepared separately. It shows all changes to your company’s value to shareholders during an accounting period. Increasing equity is positive, indicating good business practices, while decreasing equity may suggest otherwise.

What are the different stages of an audited financial statement?

When auditing a financial statement, a CPA typically goes through three stages:

- Industry Research & Risk Assessment: The CPA learns about your business, its industry, and competitors to identify risks that could affect the accuracy of your financial statement.

- Internal Control Testing: The CPA tests your company’s internal controls to understand processes for employee authorizations, delegation of responsibilities, and asset protection. They conduct procedures to verify the strength of these controls. Strong procedures may require more complex auditing, while weak ones may need additional financial assessments.

- Thorough Statement Verification: After the initial stages, the CPA verifies each item on the financial statement. For example, they may contact companies with whom you have outstanding invoices to confirm the amount owed. Following this, the CPA can provide an opinion letter, as discussed below.

What Information is Included in an Audited Financial Statement?

An audited financial statement includes the following:

- CPA Verification: Hiring a CPA to audit your financial statements helps minimize errors and increases the accuracy of your statement, even if you already track your company’s finances diligently.

- On-Site Inspection: In some cases, a CPA conducting an audit may physically inspect parts of your financial statements, such as inventory, to ensure accurate reporting.

- Internal Control Inspection: If your team includes employees responsible for monitoring company spending without much oversight, the CPA may inspect their work to reduce the risk of errors or fraud.

Opinion letter

An opinion letter is a summary provided by your CPA regarding their assessment of your financial statements. There are four types of CPA financial statement opinions:

- Unmodified Opinion: Also known as an “unqualified opinion,” this means your financial statements were prepared accurately using standard accounting practices.

- Qualified Opinion: This opinion indicates that while your financial statements are mostly accurate, there are some minor issues that need to be addressed. Your CPA will outline these problems and suggest how to correct them to obtain an unmodified opinion.

- Adverse Opinion: This opinion indicates significant inaccuracies in your financial statements, making them unreliable for investors, lenders, and other stakeholders. Your CPA will advise on how to rectify these issues to obtain a more favorable opinion.

- Disclaimer of Opinion: This is not an opinion but a statement that your CPA couldn’t complete a thorough audit due to a lack of access, information, or time.

Who should Create Audited Financial Statements?

Any business that presents its financials to investors or lenders should prepare audited financial statements. Most potential funders prefer audited statements over unaudited ones due to the higher level of reliability and accuracy they offer.

For publicly traded companies, annual audited financial statements are mandatory as per federal regulatory requirements. However, unaudited statements can be created regularly throughout the year to help assess finances.

What’s the difference between Audited & Unaudited Financial Statements?

When comparing audited and unaudited financial statements, several key differences stand out:

- Creation: Only a CPA can create an audited financial statement, while any accountant can create an unaudited one.

- Trust: An audited financial statement undergoes a thorough review by a CPA, instilling confidence in its accuracy. In contrast, the accuracy of an unaudited financial statement is not guaranteed.

- Time: Audited financial statements take weeks or months to complete due to the detailed review process, whereas unaudited statements are quicker to generate.

- Cost: Audited financial statements are more expensive to produce than unaudited ones, as they require the expertise of a CPA.

- Legitimacy: Audited financial statements are generally considered more legitimate by lenders and investors, making them crucial for businesses seeking additional funding.

The key difference between the two types of statements lies in the involvement of CPAs in the auditing process.

How do audited reports differ from other forms of accounting reports?

An audited report differs from other types of accounting reports, such as compiled and reviewed reports, in several key ways:

- Compiled Reports: These reports are basic financial statements prepared by an accountant without verifying the accuracy of the information provided. The accountant simply compiles the financial records into a standard format without further scrutiny.

- Reviewed Reports: A reviewed report undergoes a slightly higher level of scrutiny than a compiled report. The accountant performs limited analytical procedures and may ask a few questions to verify that the financial statements comply with accounting principles. However, no testing of internal controls or extensive verification is conducted.

- Audited Reports: An audited report involves a thorough examination of each item on the financial statement. It includes testing of internal controls to ensure the accuracy of the financial information. An audit provides a high level of assurance that the financial statements are accurate and reliable.

In summary, while compiled and reviewed reports offer varying levels of assurance, an audited report provides the highest level of assurance regarding the accuracy of the financial statements.