Finance

What is the Statement of Shareholders Equity?

In this article, we’ll get into the details of shareholders equity to give investors a clearer picture of a company’s financial status. At USA Timely, we’re breaking down the key elements of the statement of shareholders equity, offering a detailed explanation in easy words.

What is Shareholders Equity?

Shareholders Equity, also referred to as stockholders or owners equity, represents the portion of a company’s assets that remains after all liabilities have been settled. It’s essentially what would be left over for shareholders if the company were to liquidate all its assets and pay off all debts.

Calculation and Components

To calculate shareholders equity, you subtract total liabilities from total assets. Alternatively, you can add together share capital and retained earnings, then subtract treasury shares. This gives you a snapshot of the company’s financial health from the shareholders perspective.

Components of Shareholders Equity

Shareholders equity comprises various components, including:

- Common Stock: This represents the initial investment made by shareholders when they purchased shares of the company.

- Paid-in Capital: This is the amount investors paid for shares that exceeds the stock’s par value. It includes any additional paid-in capital from issuing new shares.

- Retained Earnings: This is the accumulated profits the company has retained rather than distributed to shareholders in the form of dividends. It reflects the company’s profitability over time.

- Treasury Stock: This refers to shares of the company’s own stock that it has bought back from shareholders. It’s recorded as a negative value because it reduces shareholders equity.

Significance

Shareholders Equity is a crucial metric for investors as it provides insights into the company’s financial stability and potential for growth. If the value of shareholders equity is negative, it could indicate financial distress, especially if the company has significant debt obligations. In such cases, investors may interpret it as a warning sign of possible bankruptcy.

Understanding shareholders equity helps investors make the right decisions about whether to invest in or continue holding shares of a particular company. It offers valuable insights into the company’s financial position and its ability to generate returns for shareholders in the long term.

What is the Statement of Shareholders Equity?

The Statement of Shareholders Equity, sometimes referred to as Stockholders Equity, is an important component of the balance sheet, offering insights into a company’s financial health. It provides a clear snapshot of the firm’s operations after accounting for all assets and liabilities, serving as a crucial tool for shareholders, investors and business owners to gauge performance.

Measurement and Frequency

The difference between total assets and total liabilities on the Statement of Shareholders Equity is typically assessed on a monthly, quarterly or annual basis. This statement is prominently featured on the balance sheet, alongside two other essential financial documents: the income statement and the cash flow statement.

Factors Influencing Shareholders Equity

Shareholders Equity can increase through various means, such as additional capital injections from owners or investors, or through increased profits resulting from higher sales volume or improved margins achieved by cost-cutting measures.

Importance over Income Statement

While many business owners prioritize tracking income, overlooking the Statement of Shareholders Equity can lead to a skewed understanding of the company’s overall performance. According to Craig M. Steinhoff, a certified public accountant, this statement is often neglected in favor of the income statement or cash flow statement. However, understanding Shareholders Equity is crucial for accurately assessing a company’s worth, performance and investment potential.

Overcoming Intimidation

Despite its importance, some business owners find the Statement of Shareholders Equity intimidating due to its complexity. However, Steinhoff emphasizes the importance of educating oneself on this aspect of financial reporting. Whether through online research, seeking advice from advisors or finding a mentor, investing time in understanding Shareholders Equity is invaluable for informed decision-making.

Steinhoff stresses the significance of ongoing education, emphasizing that it’s never too late to learn. By investing time and effort into understanding the Statement of Shareholders Equity, business owners can gain valuable insights into their company’s financial standing and make informed strategic decisions for future growth and success.

Breaking Down the Statement of Shareholders Equity

The Statement of Shareholders Equity plays a critical role in understanding a company’s financial dynamics. Let’s unpack its components, shedding light on their significance and how they reflect on the company’s financial health.

Share Capital: The Foundation

Share Capital represents the funds that investors have poured into the company by purchasing its shares. This includes both ordinary and preferred stocks, marking the investors ownership stakes. The statement tracks any shifts in capital structure over a period—highlighting increases through new share issuance and decreases from share buybacks or sales.

Lenders and investors want proof that they won’t lose money when they request for business funding. You should bring thorough financial statements to your pitch meeting in order to provide this. If they’re still unsure about your company’s financial situation, though, it could be because you haven’t put together an audited financial statement.

Common Stock: The Democratic Share

Holders of common stock enjoy voting rights on corporate decisions, standing at the forefront of company governance. However, they fall behind bondholders and preferred shareholders when it comes to payout priorities during liquidation, receiving their share after these stakeholders have been compensated.

Preference Stock: The Preferential Treatment

Preference stock holders sit a notch above common stockholders, claiming dividends and liquidation proceeds earlier. Unlike common stockholders, they typically don’t have voting rights but they enjoy a more secure position regarding earnings and assets.

Treasury Stock: The Buyback Impact

Treasury Stock accounts for the company’s shares that were repurchased and held by the corporation itself, leading to a reduction in overall share capital. It represents the difference between issued shares and those available in the market (outstanding shares).

Retained Earnings: The Growth Engine

Retained earnings accumulate the company’s profits over time haven’t been paid out as dividends. This reservoir funds working capital needs asset acquisitions, debt repayments and further investments for growth. A consistent increase in retained earnings points to a profitable operation with reinvestment for future expansion.

Dividend Payments: Sharing the Wealth

Dividends are the company’s way of distributing a portion of its profits to shareholders, rewarding them for their investment. The decision to pay dividends and the amount disbursed comes from the retained earnings and is at the company’s discretion.

Net Profit: The Bottom Line

Net profit or net income, is what remains after all expenses and deductions have been subtracted from total revenue. This figure is crucial for shareholders, indicating the company’s profitability and efficiency in managing its operations.

Other Comprehensive Income

This component captures gains and losses from activities not included in the income statement, like foreign currency transactions and hedging. These are unrealized and impact the national financial status indirectly, reflecting items like pension liabilities that haven’t been formally recognized in net income yet.

Each component of the Statement of Shareholders Equity offers a unique lens through which to view the company’s financial standing, investment potential and strategic direction. Understanding these elements enables stakeholders to make right decisions and gauge the company’s future prospects.

Purpose of the Statement of Shareholders Equity

The Statement of Shareholders Equity serves as a vital tool for small business owners, providing insights into the company’s financial health and performance over time. Let’s delve into three key reasons why this statement is invaluable for assessing the well-being of a business.

1. Making Informed Financial Decisions

One of the primary purposes of the Statement of Shareholders Equity is to assist business owners in making sound financial decisions. By understanding the company’s worth after accounting for expenses, owners can assess whether additional borrowing is necessary for expansion, evaluate the need for cost-cutting measures or determine the potential benefits of selling the business. Moreover, when seeking outside investors, presenting this statement can instill confidence by providing a clear picture of the company’s financial position.

2. Evaluating Business Performance

The Statement of Shareholders Equity also serves as a tool for evaluating how effectively the business is being managed. A decline in stockholder equity from one accounting period to the next may indicate inefficiencies or mistakes in business operations. By closely monitoring changes in shareholders equity over time, owners can identify areas for improvement and take corrective action to enhance business performance.

3. Overcoming Financial Challenges

During challenging times, such as economic downturns or unexpected crises like the COVID-19 pandemic, the Statement of Shareholders Equity becomes even more active. It provides critical insights into whether the company has generated enough income to sustain operations and whether it possesses sufficient equity to weather financial hardships. This statement can help owners determine if seeking additional financing from banks is feasible, assess the potential value of selling the business or evaluate the attractiveness of bringing new investors.

In short, the Statement of Shareholders Equity serves as a compass for navigating financial decisions, evaluating business performance and overcoming obstacles, enabling small business owners to steer their enterprises toward long term success and resilience.

Guide to Calculating Shareholders Equity

Calculating the equity held by shareholders is straightforward when you understand the formula and where to find the necessary data. Here’s how you can break it down:

The Formula for Shareholders Equity

To figure out shareholders equity, simply subtract total liabilities from total assets:

Shareholders Equity = Total Assets – Total Liabilities

Gathering the Essential Data

The balance sheet of a company is your go-to source for all the numbers you need for this calculation. It lists both assets and liabilities, categorized as either current or long-term.

Assets

- Current Assets: These are assets that you can quickly convert into cash within a year, such as cash itself, money owed to you (accounts receivable), and inventory.

- Long-term Assets: These are investments or property that you can’t easily turn into cash within a year. This category includes investments, real estate, equipment, and intellectual property like patents.

Liabilities

- Current Liabilities: These are debts or obligations that need to be settled within the next year, like bills you need to pay (accounts payable) and taxes due.

- Long-term Liabilities: These debts are more of a long haul, not due within the next year, such as bonds issued, lease obligations, and pensions.

Stockholders Equity and Paid-In Capital

When it comes to financing their operations and growth, companies leverage a mix of equity (stockholders equity) and borrowed funds. Essentially, stockholders equity represents the company’s net worth (assets minus liabilities). Investors chip in with their paid-in capital, laying the foundation for the company’s equity. The size of an investor’s contribution also determines their stake in the company.

The Impact of Retained Earnings

Retained earnings refer to the portion of net income a company decides to keep, rather than distribute as dividends, to reinvest in its business. This reinvestment acts as an additional source of equity. Over time, these retained earnings can grow to surpass the initial equity contributions, becoming a key component of stockholders equity.

Treasury Shares and Their Influence

Sometimes, companies decide to buy back shares from investors, turning these into treasury shares. This move is a way to return some equity back to shareholders. While these shares remain issued, they are not counted as outstanding, meaning they don’t collect dividends or factor into earnings per share (EPS) calculations. Companies might reissue these shares to raise new capital or retire them permanently if there’s no plan to reuse them for financing.

Understanding these components and their calculations provides a clear picture of a company’s financial health and the value it offers to its shareholders.

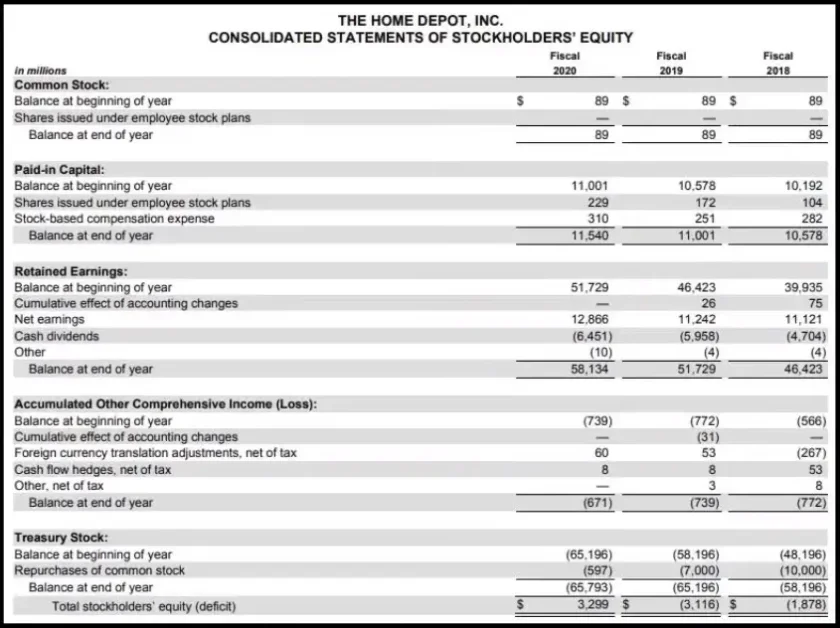

Here is an example of the statement of shareholder equity by The Home Depot Inc: