Finance

Amortization Vs Depreciation: What’s the Difference?

Amortization vs Depreciation: An Overview

When a company buys an asset like a vehicle, goodwill, headquarters or a patent, it’s usually for the long term. These assets provide value over time, not just when they’re purchased. To show this accurately, businesses can spread out the cost of these assets over their useful lives. Each year, a portion of the cost is expensed, which helps reduce the business’s taxable income and lowers its tax bill.

Amortization and depreciation are the two main methods of calculating the value of these assets. The key difference between them lies in the type of asset being expensed. There are also differences in the methods allowed, components of the calculations and how they are presented on financial statements.

Have you ever tried to take money from investors? One prominent type of statement is an audited financial statement that is used to win the investors trust while borrowing money.

Key Facts

- Amortization and depreciation are two methods businesses use to calculate the value of their assets over time.

- Amortization specifically applies to intangible assets, like patents or trademarks. It spreads out the cost of these assets over their useful lives.

- Depreciation, on the other hand, is used for tangible assets, like machinery or buildings. It reflects the gradual wear and tear or obsolescence of these assets over time.

- One key difference between amortization and depreciation is the variety of depreciation methods available, compared to the more standardized straight-line method typically used for amortization.

- Another difference is how salvage value, if any, is factored in and whether accelerated expensing methods are used. These differences can also impact how these expenses are reported on financial statements.

Amortization

Amortization is the accounting practice of spreading the cost of an intangible asset over its useful life. Unlike physical assets, intangible assets have value but no physical presence. Examples of such assets include patents, trademarks, franchise agreements, copyrights, costs of issuing bonds to raise capital and organizational costs.

The straight-line method is typically used to expense amortization, meaning the same amount is expensed in each period over the asset’s useful life. Intangible assets usually do not have any salvage or resale value.

There is another unrelated context where the term amortization is used. An amortization schedule is often used to calculate a series of loan payments consisting of both principal and interest in each payment, as in the case of a mortgage. This concept is somewhat similar, as it involves the reduction of the carrying value of the balance of an intangible item, such as a loan. Companies such as Blursoft specialize in Merchant Cash Advance (MCA), which is one source for quick financing.

“FYI: The term amortization is used in both accounting and lending, with quite distinct meanings and applications.”

Depreciation

Depreciation is the process of spreading out the cost of a tangible asset over its useful life. Tangible assets are physical items that a business owns, such as buildings, equipment, vehicles and machinery.

Unlike intangible assets, tangible assets often retain some value even after they have been used. Depreciation is calculated by subtracting the asset’s salvage or resale value from its original cost. The remaining value is then spread out evenly over the asset’s expected life. Each year, a portion of this depreciated amount is expensed, which reduces the business’s taxable income.

For example, imagine a business buys an office building. Over time, the business may move to a new location, but the old building still has some value. The cost of the building, minus its resale value, is spread out over the building’s predicted life, with a portion of the cost expensed each year. While moving your office, you must be familiar with the pros and cons of office leasing.

Depreciation can also be done on an accelerated basis for some assets, meaning that a larger portion of the asset’s value is expensed in the early years of its life. Vehicles are often depreciated in this way.

“Important: The definition of depreciation is a diminution in value over time.”

Depreciation Methods

Companies have several options for depreciating their assets. Some common methods include:

- Straight-Line Method: This method spreads the depreciation evenly over the asset’s useful life. The annual depreciation amount is calculated by subtracting the salvage value from the asset’s cost and dividing it by the useful life.

- Declining Balance Method: With this method, a fixed percentage is applied to the asset’s book value each year. The percentage is higher in the early years and decreases over time.

- Double Declining Balance Method: This method is similar to the declining balance method, but the depreciation rate is doubled. This results in higher depreciation expenses in the early years.

- Sum-of-the-Years’ Digits Method: This method calculates depreciation based on the sum of the asset’s useful life digits. For example, for an asset with a useful life of 5 years, the sum would be 15 (5+4+3+2+1). The depreciation expense is then calculated based on the fraction of the total digits remaining each year.

- Units of Production Method: This method calculates depreciation based on the asset’s usage. The total units of production expected over the asset’s life are estimated, and depreciation is charged based on the actual units produced each year.

Each method has its own advantages and disadvantages and companies choose the method that best fits their needs and accounting practices.

Key Differences

Now that we’ve covered some of the most obvious distinctions between amortization and depreciation, let’s look at some of the specific elements that distinguish these two concepts.

Applicability

Depreciation, by definition, applies exclusively to actual, tangible assets whose expenses are dispersed over their useful lives. Alternatively, amortization applies only to intangible assets.

General Philosophy

“Depreciate” signifies the reduction in value of an asset over time, while “amortize” refers to spreading out a cost over a period. Depreciation is logged to indicate that an asset no longer holds its previous value as shown on the financial statements.

Amortization, conversely, is logged to spread costs over a specific period. While the methods seem similar, their underlying philosophies are distinct.

Options of Methods

Intangible assets are typically amortized using the straight-line method, where the same amount of amortization expense is recognized each year. In contrast, companies have several depreciation methods to choose from for tangible assets.

These options allow companies to vary the amount of depreciation expense recognized each year, which can impact the calculation of net income.

Timing (Acceleration)

Companies can choose to accelerate depreciation for tangible assets, which means recognizing more depreciation expense earlier in the asset’s useful life. This is often done because assets tend to be used more heavily when they are new.

Tangible assets can often use the modified accelerated cost recovery system (MACRS) for this purpose. However, amortization for intangible assets typically does not allow for this acceleration, and the same amount of expense is recognized each year regardless of the age of the asset.

Use of Salvage Value

Depreciation and amortization formulas differ due to the consideration of salvage value. In depreciation, the depreciable base of a tangible asset is decreased by its salvage value. However, in amortization, the base of an intangible asset is not adjusted for salvage value.

This distinction arises because tangible assets, such as old cars or buildings, may have some residual value that can be realized upon disposal. In contrast, intangible assets typically do not have a salvage value.

Use of Contra Account

In amortization, the credit side of the entry may be directly applied to the intangible asset account, depending on the asset and its significance. However, in depreciation, entries are consistently posted to accumulated depreciation, which is a contra account used to decrease the carrying value of capital assets.

Amortization vs Depreciation Table

| Amortization | Depreciation |

| Applies only to intangible assets | Applies only to physical assets |

| Philosophically spreads an asset’s cost | Philosophically reduces an asset’s value |

| Generally is only done using the straight-line method | Has many different methods a company may choose from |

| Often results in the same amount recorded each year | May result in accelerated, inconsistent amounts recorded |

| Doesn’t incorporate salvage value when determining base | May incorporate salvage value when determining base |

| May not always use contra assets | Always uses contra assets |

Special Considerations

Depletion

Depletion is a method used to account for the cost of natural resources in business. It applies specifically to resources like oil wells that have a limited lifespan. For example, an oil well will eventually run out of oil, so its setup costs are spread out over its expected lifespan.

There are two main types of depletion allowance: percentage depletion and cost depletion. Percentage depletion allows a business to deduct a fixed percentage of depletion from the gross income earned from extracting natural resources. Cost depletion, on the other hand, considers factors like the property’s basis, the total recoverable reserves, and the number of units sold.

Cash Flow

One significant similarity between depreciation, amortization, and depletion is that they recognize an expense without an associated cash outflow. Because of this, these expenses are often considered misleading and may be excluded from certain reports to provide a clearer picture of operating needs.

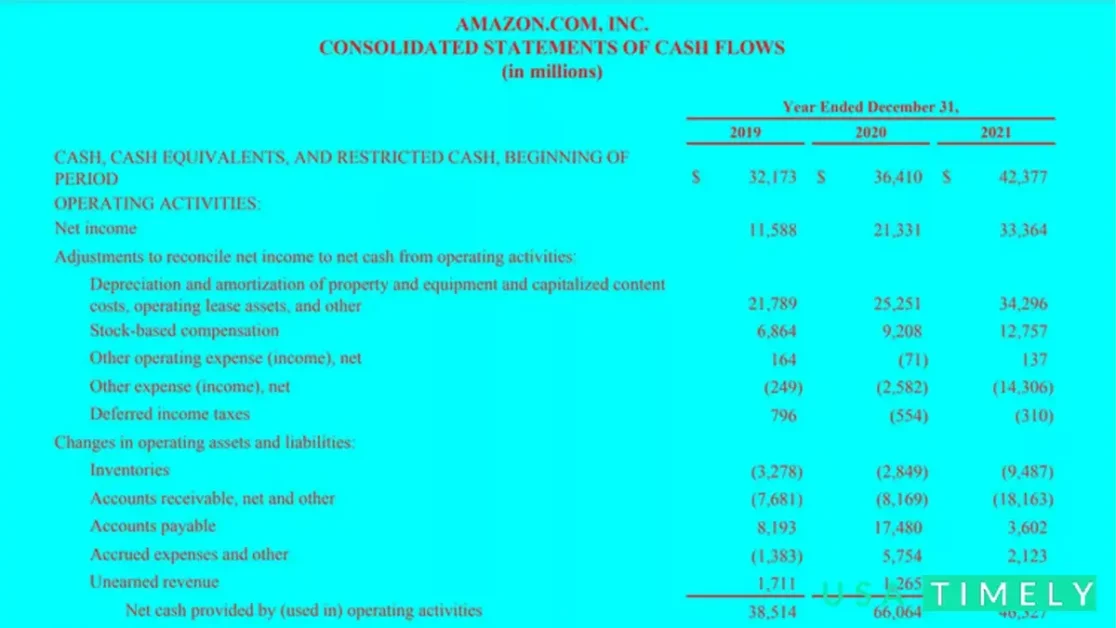

For instance, when preparing a statement of cash flow, companies typically treat depreciation and amortization as non-cash transactions. This treatment is important because it helps companies plan for capital expenditures that may require upfront capital, without being misled by non-cash expenses.

Example of Amortization vs. Depreciation

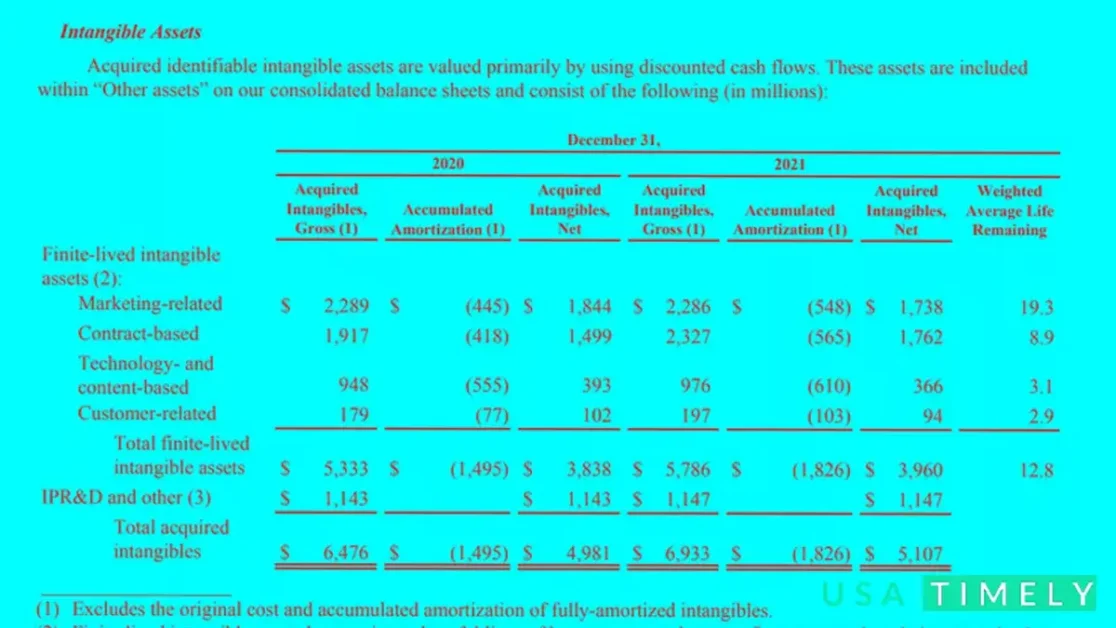

Amazon’s (AMZN) 2021 annual report includes full-year comparative financial statements supported by financial statement comments. According to the company’s cash flow statement, Amazon aggregated depreciation and amortization, reporting $34,296 in combined activity.

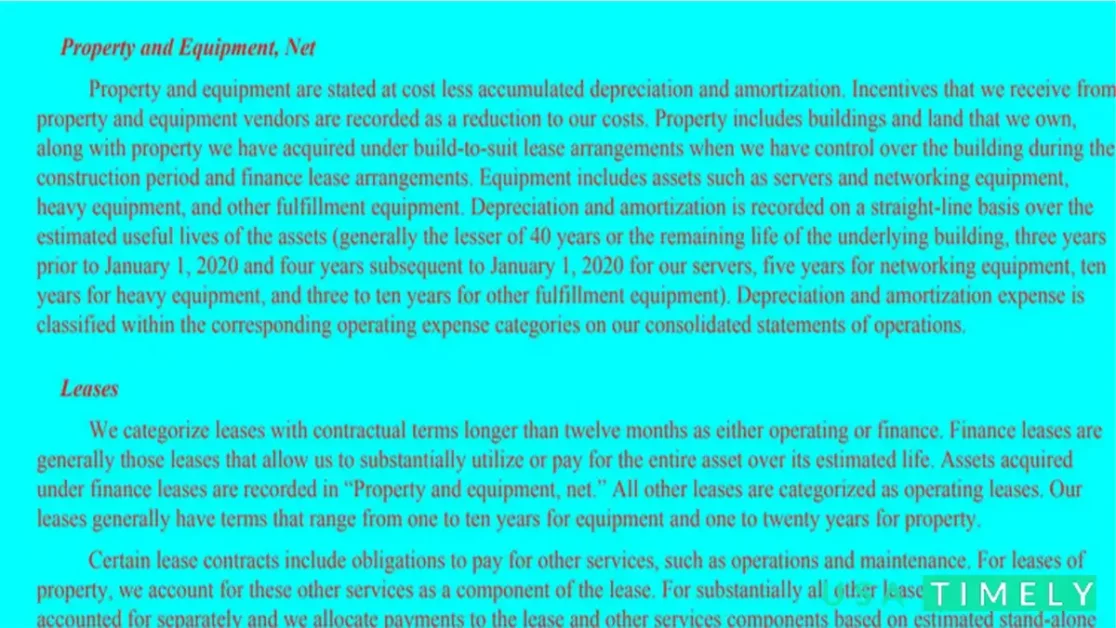

As is customary in financial statement disclosures, Amazon revealed how it handles depreciation and amortization. For both, the organization employs the straight-line approach. However, depending on the underlying asset, it uses a wide range of usable lifespan.

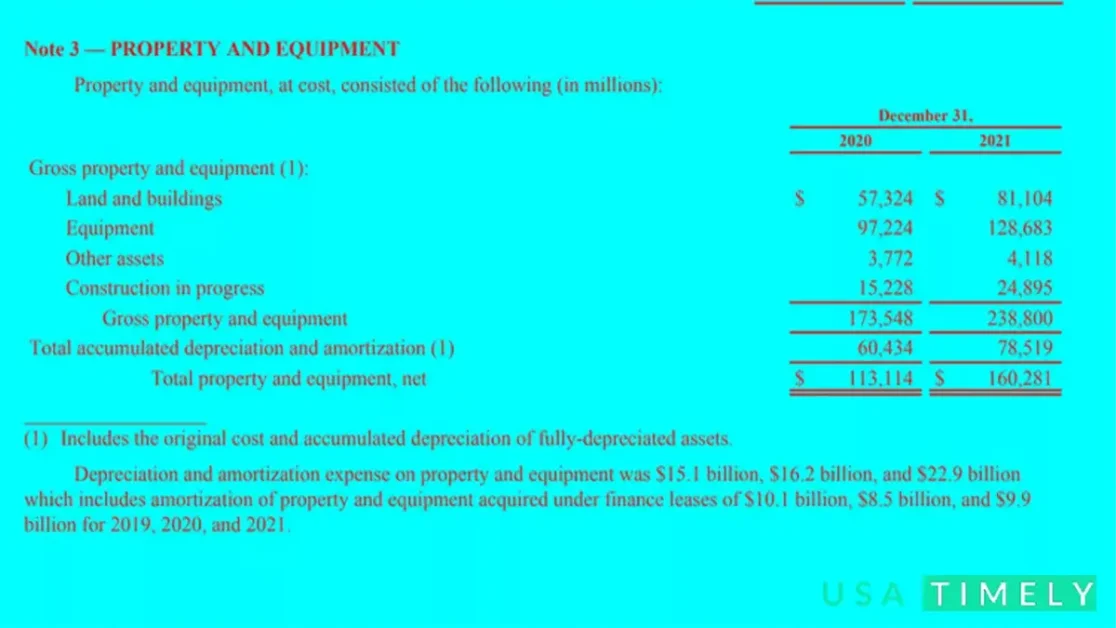

Amazon’s gross property and equipment were valued at $238.8 billion as of 2021. Only $78.5 billion of accumulated depreciation and amortization was recognized. This implies that around one-third of the company’s fixed assets were depreciated. In addition, you’ll see that this portion includes non-depreciable land. After the year, Amazon reported $160.3 billion in net property and equipment.

Amazon offered new information about its intangible assets. It characterized its intangible assets as finite-lived or in-process for use in research and development. Most of the company’s intangible assets had a limited lifespan and were either marketing-related or contract-based. At the end of 2021, the firm had about $7 billion in intangible assets but accrued amortization of more than $1.8 billion.

Correction (January 20, 2022): An earlier version of this article incorrectly listed land as an asset that may be depreciated. According to the IRS, land cannot be depreciated.

Frequently Asked Questions

What Is an Example of Amortization?

An example of amortization is when a company spreads the cost of a patent over its useful life. For instance, if a company owns a patent for 10 years and decides not to renew it, they may amortize the cost of the patent over the decade, recognizing 10% of the expenses each year. This process reduces the carrying value of the trademark over time.

What Is an Example of Depreciation?

An example of depreciation is the sum-of-the-years digits method, which involves an accelerated depreciation of tangible assets like vehicles. With this method, a company recognizes a higher portion of depreciation expense during the early years of an asset’s life. This approach acknowledges that newer assets are typically more efficient and in greater use than older ones.

Why Do We Amortize a Loan Instead of Depreciating a Loan?

Loans are amortized because they are intangible assets. Unlike physical assets, loans do not deteriorate in value or wear down over use. Additionally, the original asset value of a loan holds little relevance for financial statements. Therefore, companies amortize loans to reflect their current level of debt, rather than their historical value less a contra asset.

How Do I Know Whether to Amortize or Depreciate an Asset?

Accounting guidelines, such as GAAP, dictate how different types of assets should be treated. In general, physical, tangible assets (with some exceptions for non-depreciable assets) are depreciated, while intangible assets are amortized.

Is It Better to Amortize or Depreciate an Asset?

There is no inherent advantage to amortizing or depreciating an asset. Accounting guidelines determine the appropriate treatment based on the nature of the asset. Both methods spread the cost of an asset over its useful life, and the choice between them depends on the asset’s characteristics and accounting rules.

Sum Up

Two common techniques are employed to spread the benefit of an asset and its associated costs over time. Both depreciation and amortization serve to reduce the carrying value of assets and recognize expenses as assets are utilized over time. However, while depreciation is utilized for physical assets, amortization is employed for intangible assets. Additionally, there are disparities in the available methods, options for acceleration, the treatment of salvage value, and the utilization of contra accounts.