Finance

Housing Market Crash

What is Housing Market Crash?

A housing market crash occurs when property prices plummet sharply within a brief timeframe. This poses a significant concern for homeowners, as it signifies a substantial decline in their property’s value, with the possibility of further depreciation.

USA Timely Explains What the Housing Market Crash Means

A housing market crash happens when property prices drop abruptly over a short span. This decrease affects both current homeowners and potential buyers, as it signifies decline in house values.

How Do Housing Market Crashes Affect Homeowners?

A housing market crash negatively impacts homeowners by reducing the value of their properties. The effects vary among homeowners:

- Sellers might need to lower prices to attract buyers.

- Homeowners who bought at high prices might find themselves in negative equity, owing more than the property’s worth.

- Those who can afford mortgage payments hope for future price increases to recover.

- However, if the crash is due to economic factors, some may struggle to make payments and risk losing their homes.

Can Anyone Benefit from a Housing Market Crash?

Yes, some individuals can benefit from a housing market crash. First-time buyers, for instance, may find properties more affordable, allowing them to purchase a home for less than they might have previously. They could also consider buying a larger property than originally planned. Buying during a crash could lead to significant profits when property values eventually rebound.

Property prices tend to recover over time, so purchasing during a market downturn can be advantageous. However, predicting the market’s bottom or the duration until prices begin rising again can be challenging.

A History of Housing Market Crashes

Housing market crashes have occurred periodically throughout history. One of the most recent crashes happened during the 2008 financial crisis, triggered by a combination of a collapsing US housing market and irresponsible lending practices that led to a global economic downturn.

Similar crashes occurred in the early 1990s, mid-1970s, 1950s, and even during the Great Depression of the 1920s. These crashes result from various factors, including economic recessions and changes in government policies.

The consequences of such crashes are significant, often leading to job losses and widespread economic uncertainty.

Causes of the Housing Market Crash

Several factors can contribute to a housing market crash, impacting people’s willingness and ability to buy properties. Here are some key economic factors:

- Overinflated property prices: When property prices rise too quickly, they can become overvalued, leading to a bubble that eventually bursts.

- Economic downturn: A general decline in economic activity can reduce people’s confidence and ability to invest in property.

- Increasing unemployment: Job losses can make it difficult for people to afford housing, leading to a decrease in demand.

- Government policy changes: Changes in government regulations or policies related to housing can impact the market, such as changes in tax laws or mortgage regulations.

- Increasing interest rates: Higher interest rates can make mortgages more expensive, reducing affordability and slowing down the housing market.

- High inflation: Rapidly rising prices for goods and services can reduce people’s purchasing power, affecting their ability to buy homes.

- Less access to mortgages: Tighter lending standards or reduced availability of credit can make it harder for people to secure financing for home purchases.

Housing Bubble

A housing bubble occurs when property prices increase rapidly due to high demand, speculation, and easy access to cheap loans. It typically forms when there’s a shortage of available properties, leading sellers to raise prices.

The bubble bursts when buyers realize that properties are overpriced or when economic conditions, like rising interest rates, make buying less affordable.

Interest Rates & Housing Market Crash

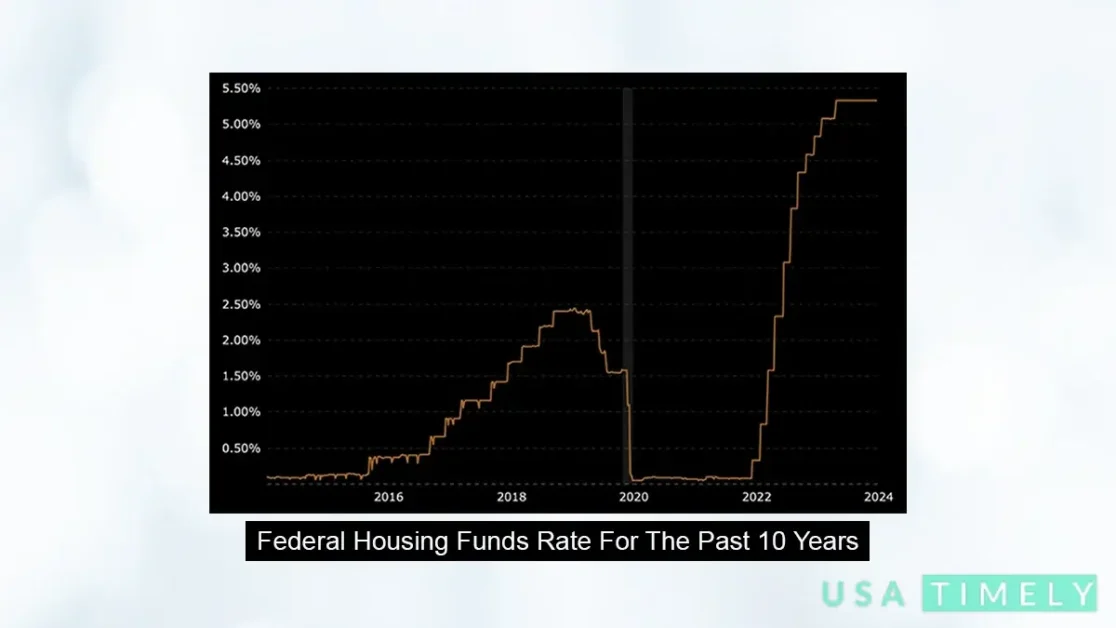

Interest rates can have a significant impact on a housing market crash. Low interest rates make borrowing cheaper, which increases affordability and makes buying a property more attractive.

Conversely, when interest rates rise, borrowing costs increase, making it more expensive to buy a home. This can reduce demand in the housing market and potentially lead to a downturn.

Examples of Recent Housing Market Crashes

The most recent housing market crash occurred between 2007 and 2009. It was fueled by a housing bubble that formed due to easily available credit and rapidly increasing property prices. A significant contributor was the rise in subprime mortgages, which are loans extended to buyers with less-than-ideal credit histories.

As the overinflated housing market corrected itself, the subprime market collapsed, leading to many lenders going bankrupt.

How Housing Market & Economy are Linked

The housing market and the economy are closely connected, as noted in a report.

When home prices rise, homeowners feel wealthier and more confident. Some may borrow against their home’s value to spend on goods, renovate, save for retirement, or pay off debts.

Conversely, falling home prices can worry homeowners that their property is worth less than their mortgage. This concern can lead to reduced spending and a reluctance to invest.

Will the Housing Market Crash?

At the beginning of 2024, there were concerns about potential turbulence in the housing markets of several countries. However, industry observers now seem more optimistic.

In the US, the economic outlook is generally positive, with Freddie Mac, the Federal Home Loan Mortgage Corporation, predicting a modest recovery in home sales. They expect home prices to continue rising due to increased demand from first-time homebuyers and a shortage of supply. They forecast a 2.5% increase in home prices in 2024 and a 2.1% increase in 2025.

In the UK, property values rose by 0.7% in February, though they are still around 3% below the all-time highs seen in the summer of 1992. The decline in borrowing costs has stimulated activity in the housing market, with a rise in new buyer inquiries. However, uncertainties remain, particularly regarding future interest rates.

Frequently Asked Question

What is a housing market crash?

A housing market crash is a significant decrease in property prices that occurs over a short period of time.

Would 2024 be a good time to buy a house?

Whether 2024 is a good time to buy a house depends on your financial situation, long-term goals, and your belief about the possibility of a real estate market crash this year.

Should I buy a house now or wait for a recession?

The decision to buy a house now or wait for a recession depends on your personal circumstances. Economists are currently divided on whether the US will enter a recession in 2024.

Will housing be cheaper if the market crashes?

Yes, property prices are typically lower after a housing market crash. However, it’s uncertain whether prices will continue to decline after a crash.

An increasing number of individuals are considering investing in digital real estate as the sector is evolving. This kind of investment doesn’t require a big down payment or entail the same significant risks as traditional real estate.

Final Bite

A housing market crash can devastate homeowners because it leads to a decrease in property values. In severe cases, a crash may result from an economic downturn or increasing interest rates, making mortgage payments unaffordable.

Predicting when a crash will happen or when the market will bottom out is challenging. Potential homeowners should ensure they do not overextend themselves financially when taking out a mortgage.