Finance

Openhouseperth.net Insurance: Tailored Coverage for Perth Homeowners

You’ve been hearing a lot about openhouseperth.net insurance lately. It seems like everyone is talking about it, but do you really understand what it’s all about? Don’t worry, you’re not alone. Openhouseperth.net insurance is a novel idea that is gaining a lot of attention, it can be complicated if you don’t understand the fundamentals. This article will break it down in simple terms so you can wrap your head around exactly what openhouseperth.net insurance is, why it’s important, and how it might impact your life. In 10 quick lessons, you’ll get up to speed on everything openhouseperth.net insurance related so you can join the conversation and sound like an expert.

Understanding the Importance of Home Insurance for Homeowners

When you buy a home, you’re making one of the biggest investments of your life. But without the right insurance coverage, that investment—and everything inside it—could be at risk from unexpected events like fires, storms, floods, or theft.

Having proper home insurance gives homeowners peace of mind. It means knowing that your investment is financially protected. The right policy doesn’t just cover the structure of your home; it also safeguards your belongings inside, saving you from significant costs that can arise from unfortunate incidents.

For most mortgage lenders, having insurance is mandatory. So, having the right policy isn’t just about protecting your investment; it’s also an essential part of owning a home. Home insurance brings stability and security, allowing families to enjoy their property without the constant worry of the unexpected.

Insurance with Openhouseperth.net

When it comes to buying or selling a home through Openhouseperth.net, understanding the ins and outs of their property insurance offerings is essential. Let’s dive into the details of what they provide in partnership with leading insurance providers.

Buyer’s Protection: Homeowner’s Insurance

For buyers, one of the critical aspects to consider is homeowner’s insurance to safeguard their new investment. With Openhouseperth.net, you can access policies designed to shield you from unexpected events such as fire, theft, or natural disasters. These policies often include replacement cost coverage, ensuring you have the means to rebuild your home if necessary. Plus, you have the option to add extras like coverage for valuable possessions.

Seller’s Assurance: Homeowner’s Warranty

For sellers, Openhouseperth.net recommends obtaining a homeowner’s warranty. This provides a safety net for buyers by covering the home’s systems and appliances for a specified period post-sale, offering protection against breakdowns. Not only does this offer peace of mind during the transaction, but it also enhances the attractiveness of your listing to potential buyers.

Shopping Around for the Best Coverage

Regardless of whether you’re buying or selling, it’s crucial to shop around and compare rates and coverage from different insurance companies. Look for insurers with a rating of A or above to ensure reliability when it comes to filing claims. Additionally, bundling multiple policies together, such as home and auto insurance, can often lead to better rates and comprehensive coverage.

The Importance of Insurance

Ultimately, insurance provides the financial protection you need for your property. By working with Openhouseperth.net, you can find policies tailored to your specific requirements, allowing you to proceed with buying or selling your home with confidence. With comprehensive coverage, reputable providers, and the right bundling options, you can maximize the value you get from your insurance.

Insurance Options with Openhouseperth.net

When it comes to protecting what matters most, Openhouseperth.net has a range of insurance options tailored to your needs. Let’s take a closer look at the types of insurance they offer to ensure you have the coverage you need for your home, vehicle, family, and travel adventures.

Home Insurance: Protecting Your Residence

Home insurance from Openhouseperth.net is designed to safeguard your home and belongings against various risks, including fire, theft, and natural disasters. Their comprehensive packages cover not only the structure of your house but also the contents, such as furniture, electronics, and valuables, providing you with peace of mind knowing your home is protected.

Vehicle Insurance: Safeguarding Your Wheels

Whether you’re driving a car, truck, or motorcycle, vehicle insurance from Openhouseperth.net offers protection against physical damage and liability in case of an accident. With options ranging from third-party property insurance to comprehensive cover, you can select the level of coverage that best suits your needs and ensures your set of wheels is adequately protected.

Life Insurance: Providing Financial Security

Getting life insurance is essential if you want to ensure that your loved ones have financial security in the case of your death. Openhouseperth.net offers various life insurance options, including term life insurance for a fixed period and whole life insurance for lifetime coverage. Choose the policy that aligns with your needs and budget to ensure your family’s financial security.

Travel Insurance: Peace of Mind on Your Journeys

Whether you’re planning an overseas trip or a domestic holiday, travel insurance from Openhouseperth.net provides financial protection against unforeseen circumstances such as trip cancellations, medical emergencies, or lost baggage. Their policies cover both international and domestic trips, allowing you to select the coverage that best suits the destination and duration of your travels.

Affordable Protection with Openhouseperth.net Insurance

With Openhouseperth.net insurance, you can rest easy knowing that you and your assets are well protected at an affordable price. Visit their website to explore the types of insurance offered and discover competitive rates tailored to your needs. Your financial security is in good hands with Openhouseperth.net.

Finding the Right Coverage with Openhouseperth.net

So, you’ve made the smart decision to go with Openhouseperth.net for your insurance needs. Now, let’s figure out which coverage options suit you best. Openhouseperth.net offers a variety of insurance products tailored for homeowners, renters, vehicle owners, and more.

Homeowners Insurance: Protecting Your Investment

If you’re a homeowner, getting homeowners insurance is absolutely essential. It shields your most valuable asset from damage caused by events like fire, theft, or natural disasters. Basic coverage typically includes protection for your home’s structure, personal belongings, and liability. Make sure to get quotes for the right amount of coverage to fully safeguard your property. You might also want to consider additional coverage for high-value items such as jewelry or collectibles.

Renters Insurance: Safeguarding Your Belongings

As a renter, your landlord’s insurance won’t cover your personal belongings. That’s where renters insurance comes in—it fills that gap, providing coverage for items like furniture, electronics, clothing, and other personal property against damage or theft. It’s an affordable way to protect your assets, and it also includes liability coverage in case someone is injured at your rental property.

Auto Insurance: Meeting Legal Requirements

If you own a vehicle, you’re required by law to have auto insurance. But how much coverage do you really need? Liability insurance covers injuries or damage to others in an accident you cause, while collision and comprehensive coverage protect your own vehicle. Consider factors like your vehicle’s value and your budget for premiums when deciding on coverage limits. Openhouseperth.net offers policies for all types of vehicles.

Additional Coverage Options

Beyond the basics, Openhouseperth.net also offers additional coverage options such as boat, RV, motorcycle, and umbrella insurance. An umbrella policy can provide extra liability coverage above the limits of your other policies, offering added peace of mind.

Merchant Cash Advance Blursoft

Crafting Your Custom Insurance Package

By understanding your needs and exploring Openhouseperth.net’s range of products, you can tailor an insurance package that fits your unique situation. Their licensed agents are there to guide you through your options, helping you strike the right balance between coverage and cost. With the right policies in place, you can rest easy knowing that you and your assets are well protected.

Navigating the Insurance Claim Process with Openhouseperth.net

When unexpected incidents occur and you find yourself needing to file an insurance claim with Openhouseperth.net, rest assured—the process is designed to be straightforward. Here are some handy tips to ensure your claim goes smoothly:

File Promptly: Acting Swiftly

It’s crucial to report any incidents, whether it’s an accident, injury, or property damage, to Openhouseperth.net within 30 to 60 days. The sooner you file, the quicker your claim can be processed, getting you the assistance you need without unnecessary delay.

Provide Detailed Information: Paint the Picture

When filing your claim, provide a clear and detailed account of what happened. If possible, include photos as visual evidence. Be specific about the date, time, location, circumstances, and any witnesses involved. The more information you provide, the better equipped Openhouseperth.net will be to handle your claim efficiently.

Keep Records: Documenting Your Expenses

It’s essential to keep records of any expenses related to your claim, such as medical bills, vehicle repair costs, or property damage estimates. These documents serve as evidence to support the amount you’re claiming, ensuring you receive appropriate compensation for your loss.

Stay in Communication: Keeping the Dialogue Open

Regularly check in on the status of your claim and respond promptly to any requests for additional information. Being responsive and staying in touch with Openhouseperth.net’s claims representatives can expedite the resolution process, minimizing any potential delays.

Ask Questions: Clarifying Doubts

Don’t hesitate to reach out to your Openhouseperth.net claims representative with any questions or concerns you may have about the claims process or your specific claim. They’re there to assist you and guide you through each step of the process.

Exercise Patience: Understanding the Process

While Openhouseperth.net strives to process claims efficiently, some claims may take weeks or even months to resolve fully, depending on their complexity. Your patience and cooperation throughout the process can help prevent unnecessary delays.

By following these tips, you can ensure that the claims process with Openhouseperth.net goes as smoothly as possible. Rest assured, Openhouseperth.net is dedicated to handling your claim fairly and ensuring you receive appropriate compensation for your loss. If you ever feel your claim isn’t being handled properly, don’t hesitate to escalate the issue to a manager for further assistance.

Why Choose Openhouseperth.net Over Competitors

When it comes to protecting your home, Openhouseperth.net stands out from the competition in several key ways, offering tailored coverage designed specifically for Perth homeowners. Here are the benefits of choosing Openhouseperth.net:

Local Expertise: Tailored for Perth Property Owners

Unlike nationwide insurers with a one-size-fits-all approach, Openhouseperth.net understands the unique risks and claims profiles facing homeowners in Perth. Their products are designed specifically for Western Australian property owners, ensuring coverage that meets the needs of Perth residents.

Competitive Pricing: Customized for Affordability

Openhouseperth.net offers customized policies aimed at keeping premiums affordable for homeowners in Perth. By tailoring coverage to fit your individual needs, they can provide competitive pricing without sacrificing on quality or protection.

Enhanced Storm Cover: Addressing Perth’s Risks

Perth is known for its higher risk of severe storms, and Openhouseperth.net recognizes this by offering enhanced storm cover as part of their insurance policies. This ensures that Perth homeowners have adequate protection against the potential damage caused by severe weather events.

Flood Coverage: Comprehensive Protection

Unlike some insurers that exclude flood damage from their policies, Openhouseperth.net includes coverage for damage from rising water. This provides peace of mind for Perth homeowners, knowing that they are protected against the devastating effects of flooding.

Perth-Based Team: Specialized Service and Quick Response

With a team based in Perth, Openhouseperth.net provides specialized service and quick claims response to homeowners in the area. Their local representatives understand the unique challenges facing Perth homeowners and are dedicated to providing personalized assistance whenever needed.

Longstanding Experience: Trusted Reputation

Openhouseperth.net has a proven reputation and history of protecting Perth homeowners. With their longstanding experience in the industry, you can trust that you’re in good hands when you choose Openhouseperth.net for your home insurance needs.

By choosing a trusted local provider like Openhouseperth.net, you can benefit from tailored coverage designed specifically for Perth, personalized service from representatives who understand your property and lifestyle, and the peace of mind that comes from knowing your home is protected by a company with a proven track record of excellence.

Frequently Asked Questions About Openhouseperth.net Insurance

Q1. What sets Openhouseperth.net insurance apart?

Openhouseperth.net offers tailored coverage specifically designed for Perth homeowners, addressing unique risks and claims profiles.

Q2. Does Openhouseperth.net provide flood coverage?

Yes, unlike some insurers, Openhouseperth.net includes coverage for damage from rising water, providing comprehensive protection for Perth homeowners.

Q3. Why is homeowner’s insurance important?

Homeowner’s insurance protects your investment against unexpected events like fires, storms, floods, or theft, providing financial security and peace of mind.

Finance

Home Depot MyCard: Everything You Need to Know

Home Depot MyCard Login

If you have a Home Depot MyCard, logging in is simple. Visit homedepot.com/mycard and enter your username and password. If you have trouble accessing your account, use the “Forgot Password” option to reset your credentials.

How to Register on homedepot.com/mycard

New users need to register their Home Depot Credit Card before making payments. To do this:

- Visit homedepot.com/mycard.

- Click on “Register Your Card.”

- Enter your card details, including your account number.

- Create a username and password for secure access.

- Confirm your email and complete the registration process.

Home Depot Login for Account Management

Apart from MyCard, Home Depot offers an online login portal for customers to track purchases, manage their credit accounts, and check rewards. You can log in using your email and password at homedepot.com.

Making a Home Depot Payment

Customers can pay their Home Depot Credit Card bills online, by phone, or in-store. Here are the payment methods available:

- Online: Log in to your MyCard account and select “Make a Payment.”

- By Phone: Call the Home Depot Credit Card payment phone number provided on your billing statement.

- In-Store: Visit the customer service desk at any Home Depot location to pay in person.

- Mail: Send a check to the address listed on your bill.

Home Depot Credit Card Options

Home Depot, in partnership with Citibank Home Depot, offers multiple credit card options:

- Home Depot Consumer Credit Card – Ideal for regular shoppers, offering exclusive discounts and financing options.

- Home Depot Project Loan Card – Designed for large home improvement projects with flexible repayment terms.

- Home Depot Commercial Credit Card – Best for business owners who need purchasing power for large-scale projects.

Home Depot Customer Service

For any issues related to Home Depot MyCard, payments, or login problems, reach out to Home Depot customer service. You can contact them via:

- Phone: Call the customer service number listed on your card statement.

- Online Chat: Available on the Home Depot website.

- In-Store Assistance: Visit your nearest Home Depot for in-person support.

Conclusion

Managing your Home Depot MyCard is easy with online account access, multiple payment options, and excellent customer service. Whether you’re registering for the first time or need help with payments, Home Depot provides convenient solutions for all credit card users.

Finance

Merchant Cash Advance Loans Pros & Cons

In business, keeping the cash flowing smooth is important. Every business hits rough patches when sales slow down and funds get tight. During these times, seeking external funding becomes necessary. One option that many people consider is a merchant cash advance, among various others for small business financing.

What is a Cash Advance Loan?

A cash advance loan is when you borrow money upfront against what you’ll earn in the future. Essentially, the lender gives you cash before you actually get paid. It’s like trading in some of your future income for money in your pocket right now. Unlike regular loans, it’s not just about borrowing money, it’s more like selling a part of what you’ll earn later.

With personal cash advance loans, you borrow money against your upcoming paycheck. When payday rolls around, the lender takes back what you borrowed, plus some extra fees. Sometimes, they’ll have you write a check for the total amount, including fees and cash it once you’ve got the money.

These loans often come with steep fees, which can pile up fast and leave you stuck with a big debt. That’s why some people see cash advance loans as kind of predatory. But for those who don’t have a credit card, they can be a lifeline for getting some cash when you’re in a pinch.

“There’s another kind of cash advance called a merchant cash advance loan, which is specifically for businesses that need quick cash. Various benefits are offered for small business owners who choose to use merchant cash advances, particularly those provided by Blursoft.”

What is a Merchant Cash Advance?

A merchant cash advance is a way to get some quick cash if you’re having trouble getting a loan from a bank or somewhere else. It’s a short-term solution where you borrow money against what you’ll earn from credit card sales in the future. Usually, you pay back what you borrowed, plus some extra fees, within six to twelve months.

To get a merchant cash advance, your business needs to make credit card sales every day and you have to show that you’ve been making these sales for at least four months. Most companies offering these advances want to see that you’re making between $2,500 and $5,000 in credit card sales each month, depending on how much you want to borrow. This helps them make sure you’ll be able to pay back what you owe.

How does Merchant Cash Advance Work?

Merchant cash advance companies usually work with businesses that mainly take debit and credit card payments, like retail stores, service shops, and restaurants. But even if your business doesn’t have high card sales, there are still ways to get an advance:

In a traditional merchant cash advance, you’d get a lump sum upfront. Then, a fixed percentage of your daily or weekly sales are automatically taken out to pay back the advance, along with fees. This is called a “holdback.” The more sales you make, the faster you pay back the advance. But remember, it’s not cool to tell your customers to pay in cash just to avoid paying back the advance faster: that could land you in legal trouble.

Alternatively, with an ACH merchant cash advance, you also get a lump sum upfront. But instead of a percentage of your sales, a fixed amount is taken directly from your business checking account each day or week until the advance, plus fees, is paid off. Unlike the traditional method, the amount taken doesn’t change, no matter how much you’re selling. These advances can be paid off faster, unless your business runs low on cash, making it hard to make those payments.

Fees for a merchant cash advance can add up, usually ranging from 1.2% to 1.5% of the advance amount. So, if you borrow $40,000 with a 1.5% fee, you’ll end up paying back $60,000 in total – $40,000 for the advance and $20,000 in fees.

It’s important to know that merchant cash advances are way pricier than regular loans. Plus, they can get you stuck in a cycle of debt where you have to take out another advance just to pay off the first one, leading to even more fees.

Pros & Cons of Merchant Cash Advance

Merchant cash advances offer some benefits and drawbacks when compared to other types of small business loans:

| Merchant Cash Advance Pros | Merchant Cash Advance Cons |

| Almost immediate access to cash | Extremely high APR, potentially as high as 200 percent |

| Easy repayment | High payment frequency that can hinder cash flow |

| Low credit score acceptable | No impact on business credit score or report |

| No restrictions on loan use | Binding in ways that other loans aren’t |

| No need to put up collateral | Unavailable to small businesses that don’t accept credit card payments |

Alternatives for a Merchant Cash Advance

Looking for alternatives to a merchant cash advance? There are plenty of financing options out there that can provide the working capital your small business needs. USA Timely have listed a few alternatives to consider:

Business Line of Credit

- Similar to a credit card, a business line of credit (LOC) gives you access to a set amount of funds that you can borrow against whenever you need it.

- You can borrow and repay as many times as you need, up to the maximum limit of your credit line.

- Approval is often quick, and repayment terms typically range from three to 12 months.

Short-Term Loan

- Offered by private lenders, short-term loans are unsecured business loans with lower interest rates and more transparency compared to merchant cash advances.

- These loans usually provide up to $500,000 in financing, with repayment terms ranging from three months to three years.

- Approval is fast, usually within a week.

“Tip: There are several lending options available to your firm. The finest small business loans provide a simple application procedure, clear pricing information and flexible payback alternatives.”

Payment Processor Financing

- If you use credit card processing services like Square or PayPal, you may qualify for financing through them.

- These loans, typically under $100,000, can be applied for directly through your online account.

- They often come with lower factor rates (around 1.1% to 1.16%) compared to merchant cash advances.

Each of these alternatives offers its own set of benefits and considerations, so it’s essential to explore which option aligns best with your business’s needs and financial situation.

“Lenders and investors want proof that they won’t lose money when they request for business funding. You should bring thorough financial statements to your pitch meeting in order to provide this. If they’re still unsure about your company’s financial situation, though, it could be because you haven’t put together an audited financial statement.”

Merchant Cash Advance FAQs

Is a merchant cash advance legal?

Yes, merchant cash advances are legal because they’re not technically loans. Instead, they involve selling a portion of your future income. The companies offering these advances aren’t subject to the same regulations as traditional lenders since the advance is usually repaid within a year.

Why use a merchant cash advance?

Despite the high fees associated with merchant cash advances, there are some reasons why businesses consider them:

- Quick access to funds: You can usually get the money within 24 to 48 hours.

- No collateral required: Your assets aren’t at risk if your business fails to fully repay the advance.

- Automatic repayments: Payments are automatically deducted, so you won’t miss any due dates.

- Flexible payments: During slow sales months, you’ll pay less back to the advance provider.

- Minimal paperwork: Applying for a merchant cash advance involves minimal paperwork compared to traditional loans.

Do merchant cash advances hurt your credit score?

While merchant cash advance providers may check your credit as part of the application process, it typically won’t impact your business credit score significantly. However, some providers may conduct a hard credit check, which could potentially lower your score. It’s essential to inquire about the type of credit check they perform before applying.

How do you apply for a merchant cash advance?

Applying for a merchant cash advance is relatively straightforward, whether online or in person. You’ll typically need to provide:

- Contact information for your business

- Your personal information, including your Social Security number

- The company’s tax ID number

- Several months of credit card processing history and bank statements

- Proof of citizenship

- A blank check or your checking account number and routing number

USA Timely explains that the application process is quick and you can usually get approved within hours or days. Once approved, you’ll sign a contract outlining the advance amount, repayment terms and other details, the funds will be transferred to your bank account.

Finance

Amortization Vs Depreciation: What’s the Difference?

Amortization vs Depreciation: An Overview

When a company buys an asset like a vehicle, goodwill, headquarters or a patent, it’s usually for the long term. These assets provide value over time, not just when they’re purchased. To show this accurately, businesses can spread out the cost of these assets over their useful lives. Each year, a portion of the cost is expensed, which helps reduce the business’s taxable income and lowers its tax bill.

Amortization and depreciation are the two main methods of calculating the value of these assets. The key difference between them lies in the type of asset being expensed. There are also differences in the methods allowed, components of the calculations and how they are presented on financial statements.

Have you ever tried to take money from investors? One prominent type of statement is an audited financial statement that is used to win the investors trust while borrowing money.

Key Facts

- Amortization and depreciation are two methods businesses use to calculate the value of their assets over time.

- Amortization specifically applies to intangible assets, like patents or trademarks. It spreads out the cost of these assets over their useful lives.

- Depreciation, on the other hand, is used for tangible assets, like machinery or buildings. It reflects the gradual wear and tear or obsolescence of these assets over time.

- One key difference between amortization and depreciation is the variety of depreciation methods available, compared to the more standardized straight-line method typically used for amortization.

- Another difference is how salvage value, if any, is factored in and whether accelerated expensing methods are used. These differences can also impact how these expenses are reported on financial statements.

Amortization

Amortization is the accounting practice of spreading the cost of an intangible asset over its useful life. Unlike physical assets, intangible assets have value but no physical presence. Examples of such assets include patents, trademarks, franchise agreements, copyrights, costs of issuing bonds to raise capital and organizational costs.

The straight-line method is typically used to expense amortization, meaning the same amount is expensed in each period over the asset’s useful life. Intangible assets usually do not have any salvage or resale value.

There is another unrelated context where the term amortization is used. An amortization schedule is often used to calculate a series of loan payments consisting of both principal and interest in each payment, as in the case of a mortgage. This concept is somewhat similar, as it involves the reduction of the carrying value of the balance of an intangible item, such as a loan. Companies such as Blursoft specialize in Merchant Cash Advance (MCA), which is one source for quick financing.

“FYI: The term amortization is used in both accounting and lending, with quite distinct meanings and applications.”

Depreciation

Depreciation is the process of spreading out the cost of a tangible asset over its useful life. Tangible assets are physical items that a business owns, such as buildings, equipment, vehicles and machinery.

Unlike intangible assets, tangible assets often retain some value even after they have been used. Depreciation is calculated by subtracting the asset’s salvage or resale value from its original cost. The remaining value is then spread out evenly over the asset’s expected life. Each year, a portion of this depreciated amount is expensed, which reduces the business’s taxable income.

For example, imagine a business buys an office building. Over time, the business may move to a new location, but the old building still has some value. The cost of the building, minus its resale value, is spread out over the building’s predicted life, with a portion of the cost expensed each year. While moving your office, you must be familiar with the pros and cons of office leasing.

Depreciation can also be done on an accelerated basis for some assets, meaning that a larger portion of the asset’s value is expensed in the early years of its life. Vehicles are often depreciated in this way.

“Important: The definition of depreciation is a diminution in value over time.”

Depreciation Methods

Companies have several options for depreciating their assets. Some common methods include:

- Straight-Line Method: This method spreads the depreciation evenly over the asset’s useful life. The annual depreciation amount is calculated by subtracting the salvage value from the asset’s cost and dividing it by the useful life.

- Declining Balance Method: With this method, a fixed percentage is applied to the asset’s book value each year. The percentage is higher in the early years and decreases over time.

- Double Declining Balance Method: This method is similar to the declining balance method, but the depreciation rate is doubled. This results in higher depreciation expenses in the early years.

- Sum-of-the-Years’ Digits Method: This method calculates depreciation based on the sum of the asset’s useful life digits. For example, for an asset with a useful life of 5 years, the sum would be 15 (5+4+3+2+1). The depreciation expense is then calculated based on the fraction of the total digits remaining each year.

- Units of Production Method: This method calculates depreciation based on the asset’s usage. The total units of production expected over the asset’s life are estimated, and depreciation is charged based on the actual units produced each year.

Each method has its own advantages and disadvantages and companies choose the method that best fits their needs and accounting practices.

Key Differences

Now that we’ve covered some of the most obvious distinctions between amortization and depreciation, let’s look at some of the specific elements that distinguish these two concepts.

Applicability

Depreciation, by definition, applies exclusively to actual, tangible assets whose expenses are dispersed over their useful lives. Alternatively, amortization applies only to intangible assets.

General Philosophy

“Depreciate” signifies the reduction in value of an asset over time, while “amortize” refers to spreading out a cost over a period. Depreciation is logged to indicate that an asset no longer holds its previous value as shown on the financial statements.

Amortization, conversely, is logged to spread costs over a specific period. While the methods seem similar, their underlying philosophies are distinct.

Options of Methods

Intangible assets are typically amortized using the straight-line method, where the same amount of amortization expense is recognized each year. In contrast, companies have several depreciation methods to choose from for tangible assets.

These options allow companies to vary the amount of depreciation expense recognized each year, which can impact the calculation of net income.

Timing (Acceleration)

Companies can choose to accelerate depreciation for tangible assets, which means recognizing more depreciation expense earlier in the asset’s useful life. This is often done because assets tend to be used more heavily when they are new.

Tangible assets can often use the modified accelerated cost recovery system (MACRS) for this purpose. However, amortization for intangible assets typically does not allow for this acceleration, and the same amount of expense is recognized each year regardless of the age of the asset.

Use of Salvage Value

Depreciation and amortization formulas differ due to the consideration of salvage value. In depreciation, the depreciable base of a tangible asset is decreased by its salvage value. However, in amortization, the base of an intangible asset is not adjusted for salvage value.

This distinction arises because tangible assets, such as old cars or buildings, may have some residual value that can be realized upon disposal. In contrast, intangible assets typically do not have a salvage value.

Use of Contra Account

In amortization, the credit side of the entry may be directly applied to the intangible asset account, depending on the asset and its significance. However, in depreciation, entries are consistently posted to accumulated depreciation, which is a contra account used to decrease the carrying value of capital assets.

Amortization vs Depreciation Table

| Amortization | Depreciation |

| Applies only to intangible assets | Applies only to physical assets |

| Philosophically spreads an asset’s cost | Philosophically reduces an asset’s value |

| Generally is only done using the straight-line method | Has many different methods a company may choose from |

| Often results in the same amount recorded each year | May result in accelerated, inconsistent amounts recorded |

| Doesn’t incorporate salvage value when determining base | May incorporate salvage value when determining base |

| May not always use contra assets | Always uses contra assets |

Special Considerations

Depletion

Depletion is a method used to account for the cost of natural resources in business. It applies specifically to resources like oil wells that have a limited lifespan. For example, an oil well will eventually run out of oil, so its setup costs are spread out over its expected lifespan.

There are two main types of depletion allowance: percentage depletion and cost depletion. Percentage depletion allows a business to deduct a fixed percentage of depletion from the gross income earned from extracting natural resources. Cost depletion, on the other hand, considers factors like the property’s basis, the total recoverable reserves, and the number of units sold.

Cash Flow

One significant similarity between depreciation, amortization, and depletion is that they recognize an expense without an associated cash outflow. Because of this, these expenses are often considered misleading and may be excluded from certain reports to provide a clearer picture of operating needs.

For instance, when preparing a statement of cash flow, companies typically treat depreciation and amortization as non-cash transactions. This treatment is important because it helps companies plan for capital expenditures that may require upfront capital, without being misled by non-cash expenses.

Example of Amortization vs. Depreciation

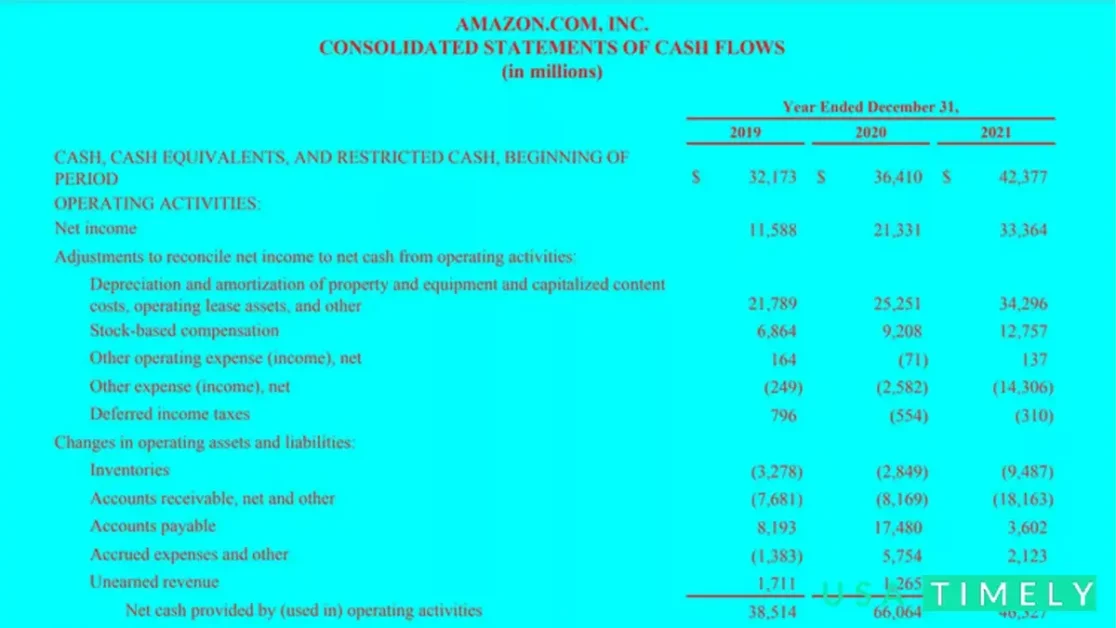

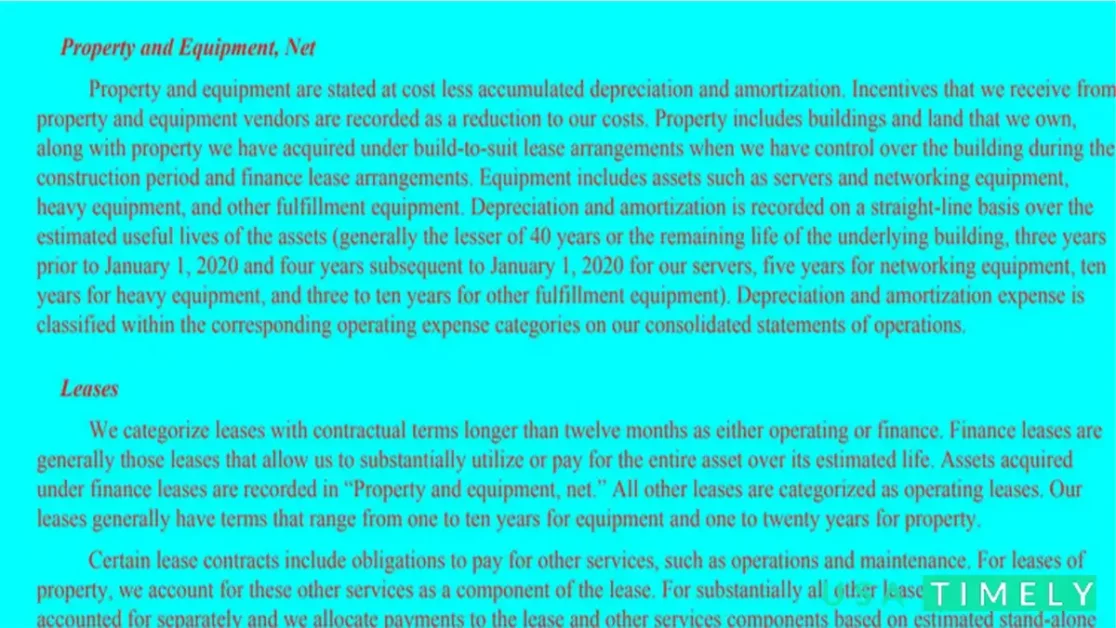

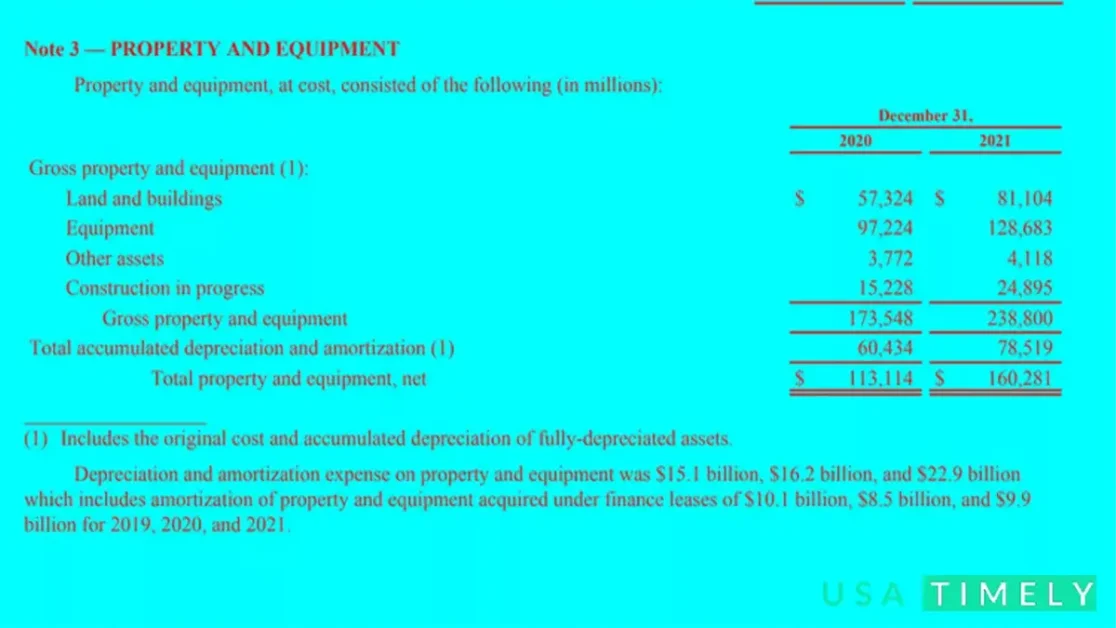

Amazon’s (AMZN) 2021 annual report includes full-year comparative financial statements supported by financial statement comments. According to the company’s cash flow statement, Amazon aggregated depreciation and amortization, reporting $34,296 in combined activity.

As is customary in financial statement disclosures, Amazon revealed how it handles depreciation and amortization. For both, the organization employs the straight-line approach. However, depending on the underlying asset, it uses a wide range of usable lifespan.

Amazon’s gross property and equipment were valued at $238.8 billion as of 2021. Only $78.5 billion of accumulated depreciation and amortization was recognized. This implies that around one-third of the company’s fixed assets were depreciated. In addition, you’ll see that this portion includes non-depreciable land. After the year, Amazon reported $160.3 billion in net property and equipment.

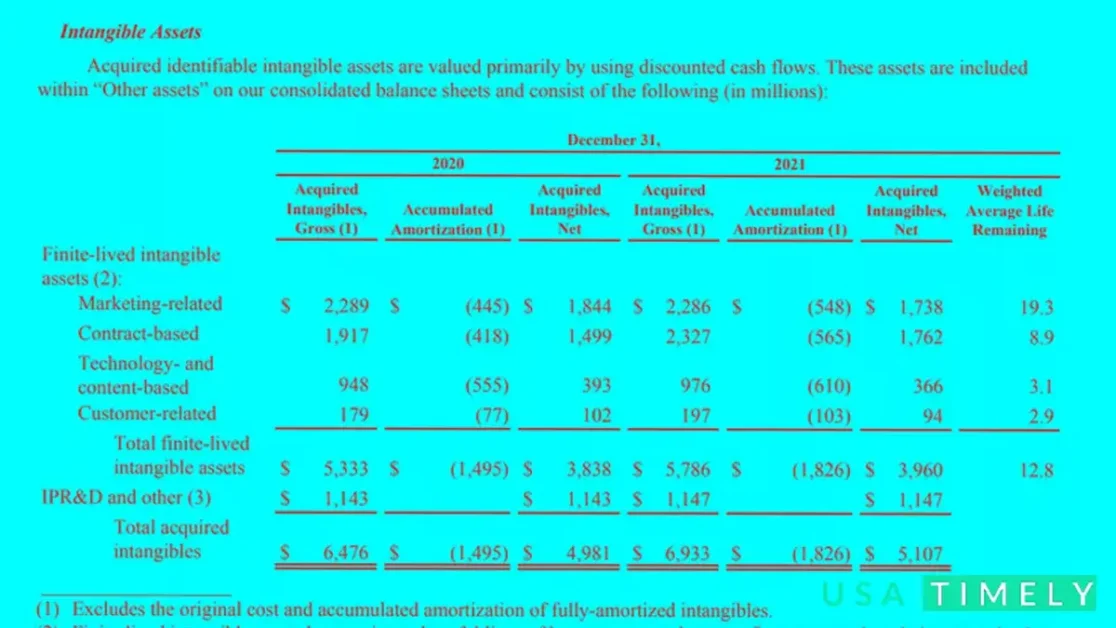

Amazon offered new information about its intangible assets. It characterized its intangible assets as finite-lived or in-process for use in research and development. Most of the company’s intangible assets had a limited lifespan and were either marketing-related or contract-based. At the end of 2021, the firm had about $7 billion in intangible assets but accrued amortization of more than $1.8 billion.

Correction (January 20, 2022): An earlier version of this article incorrectly listed land as an asset that may be depreciated. According to the IRS, land cannot be depreciated.

Frequently Asked Questions

What Is an Example of Amortization?

An example of amortization is when a company spreads the cost of a patent over its useful life. For instance, if a company owns a patent for 10 years and decides not to renew it, they may amortize the cost of the patent over the decade, recognizing 10% of the expenses each year. This process reduces the carrying value of the trademark over time.

What Is an Example of Depreciation?

An example of depreciation is the sum-of-the-years digits method, which involves an accelerated depreciation of tangible assets like vehicles. With this method, a company recognizes a higher portion of depreciation expense during the early years of an asset’s life. This approach acknowledges that newer assets are typically more efficient and in greater use than older ones.

Why Do We Amortize a Loan Instead of Depreciating a Loan?

Loans are amortized because they are intangible assets. Unlike physical assets, loans do not deteriorate in value or wear down over use. Additionally, the original asset value of a loan holds little relevance for financial statements. Therefore, companies amortize loans to reflect their current level of debt, rather than their historical value less a contra asset.

How Do I Know Whether to Amortize or Depreciate an Asset?

Accounting guidelines, such as GAAP, dictate how different types of assets should be treated. In general, physical, tangible assets (with some exceptions for non-depreciable assets) are depreciated, while intangible assets are amortized.

Is It Better to Amortize or Depreciate an Asset?

There is no inherent advantage to amortizing or depreciating an asset. Accounting guidelines determine the appropriate treatment based on the nature of the asset. Both methods spread the cost of an asset over its useful life, and the choice between them depends on the asset’s characteristics and accounting rules.

Sum Up

Two common techniques are employed to spread the benefit of an asset and its associated costs over time. Both depreciation and amortization serve to reduce the carrying value of assets and recognize expenses as assets are utilized over time. However, while depreciation is utilized for physical assets, amortization is employed for intangible assets. Additionally, there are disparities in the available methods, options for acceleration, the treatment of salvage value, and the utilization of contra accounts.

Finance

Housing Market Crash

What is Housing Market Crash?

A housing market crash occurs when property prices plummet sharply within a brief timeframe. This poses a significant concern for homeowners, as it signifies a substantial decline in their property’s value, with the possibility of further depreciation.

USA Timely Explains What the Housing Market Crash Means

A housing market crash happens when property prices drop abruptly over a short span. This decrease affects both current homeowners and potential buyers, as it signifies decline in house values.

How Do Housing Market Crashes Affect Homeowners?

A housing market crash negatively impacts homeowners by reducing the value of their properties. The effects vary among homeowners:

- Sellers might need to lower prices to attract buyers.

- Homeowners who bought at high prices might find themselves in negative equity, owing more than the property’s worth.

- Those who can afford mortgage payments hope for future price increases to recover.

- However, if the crash is due to economic factors, some may struggle to make payments and risk losing their homes.

Can Anyone Benefit from a Housing Market Crash?

Yes, some individuals can benefit from a housing market crash. First-time buyers, for instance, may find properties more affordable, allowing them to purchase a home for less than they might have previously. They could also consider buying a larger property than originally planned. Buying during a crash could lead to significant profits when property values eventually rebound.

Property prices tend to recover over time, so purchasing during a market downturn can be advantageous. However, predicting the market’s bottom or the duration until prices begin rising again can be challenging.

A History of Housing Market Crashes

Housing market crashes have occurred periodically throughout history. One of the most recent crashes happened during the 2008 financial crisis, triggered by a combination of a collapsing US housing market and irresponsible lending practices that led to a global economic downturn.

Similar crashes occurred in the early 1990s, mid-1970s, 1950s, and even during the Great Depression of the 1920s. These crashes result from various factors, including economic recessions and changes in government policies.

The consequences of such crashes are significant, often leading to job losses and widespread economic uncertainty.

Causes of the Housing Market Crash

Several factors can contribute to a housing market crash, impacting people’s willingness and ability to buy properties. Here are some key economic factors:

- Overinflated property prices: When property prices rise too quickly, they can become overvalued, leading to a bubble that eventually bursts.

- Economic downturn: A general decline in economic activity can reduce people’s confidence and ability to invest in property.

- Increasing unemployment: Job losses can make it difficult for people to afford housing, leading to a decrease in demand.

- Government policy changes: Changes in government regulations or policies related to housing can impact the market, such as changes in tax laws or mortgage regulations.

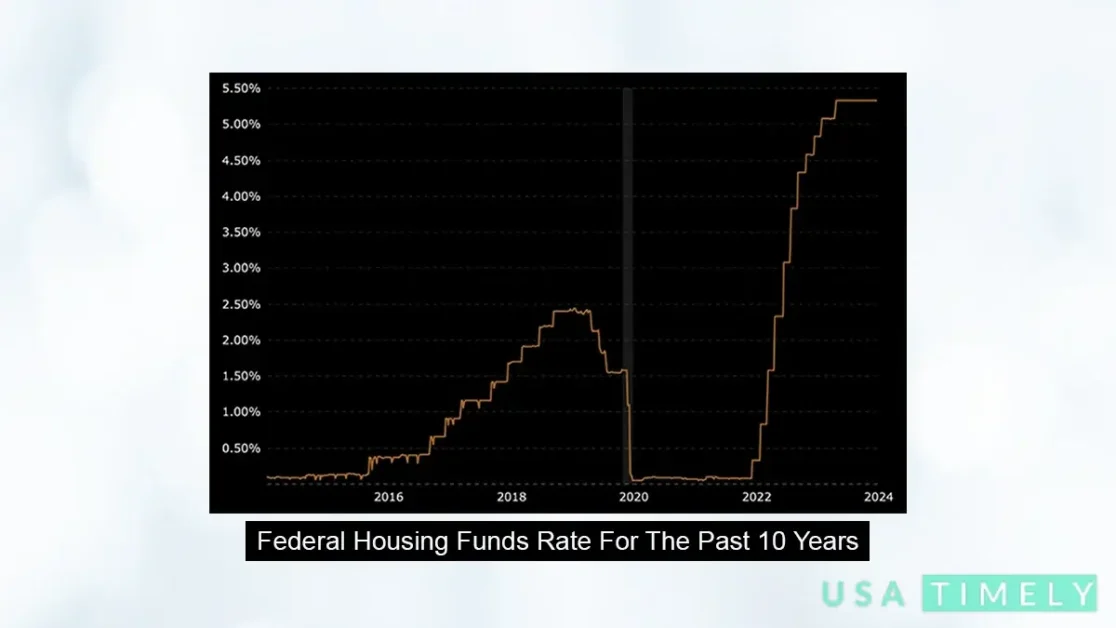

- Increasing interest rates: Higher interest rates can make mortgages more expensive, reducing affordability and slowing down the housing market.

- High inflation: Rapidly rising prices for goods and services can reduce people’s purchasing power, affecting their ability to buy homes.

- Less access to mortgages: Tighter lending standards or reduced availability of credit can make it harder for people to secure financing for home purchases.

Housing Bubble

A housing bubble occurs when property prices increase rapidly due to high demand, speculation, and easy access to cheap loans. It typically forms when there’s a shortage of available properties, leading sellers to raise prices.

The bubble bursts when buyers realize that properties are overpriced or when economic conditions, like rising interest rates, make buying less affordable.

Interest Rates & Housing Market Crash

Interest rates can have a significant impact on a housing market crash. Low interest rates make borrowing cheaper, which increases affordability and makes buying a property more attractive.

Conversely, when interest rates rise, borrowing costs increase, making it more expensive to buy a home. This can reduce demand in the housing market and potentially lead to a downturn.

Examples of Recent Housing Market Crashes

The most recent housing market crash occurred between 2007 and 2009. It was fueled by a housing bubble that formed due to easily available credit and rapidly increasing property prices. A significant contributor was the rise in subprime mortgages, which are loans extended to buyers with less-than-ideal credit histories.

As the overinflated housing market corrected itself, the subprime market collapsed, leading to many lenders going bankrupt.

How Housing Market & Economy are Linked

The housing market and the economy are closely connected, as noted in a report.

When home prices rise, homeowners feel wealthier and more confident. Some may borrow against their home’s value to spend on goods, renovate, save for retirement, or pay off debts.

Conversely, falling home prices can worry homeowners that their property is worth less than their mortgage. This concern can lead to reduced spending and a reluctance to invest.

Will the Housing Market Crash?

At the beginning of 2024, there were concerns about potential turbulence in the housing markets of several countries. However, industry observers now seem more optimistic.

In the US, the economic outlook is generally positive, with Freddie Mac, the Federal Home Loan Mortgage Corporation, predicting a modest recovery in home sales. They expect home prices to continue rising due to increased demand from first-time homebuyers and a shortage of supply. They forecast a 2.5% increase in home prices in 2024 and a 2.1% increase in 2025.

In the UK, property values rose by 0.7% in February, though they are still around 3% below the all-time highs seen in the summer of 1992. The decline in borrowing costs has stimulated activity in the housing market, with a rise in new buyer inquiries. However, uncertainties remain, particularly regarding future interest rates.

Frequently Asked Question

What is a housing market crash?

A housing market crash is a significant decrease in property prices that occurs over a short period of time.

Would 2024 be a good time to buy a house?

Whether 2024 is a good time to buy a house depends on your financial situation, long-term goals, and your belief about the possibility of a real estate market crash this year.

Should I buy a house now or wait for a recession?

The decision to buy a house now or wait for a recession depends on your personal circumstances. Economists are currently divided on whether the US will enter a recession in 2024.

Will housing be cheaper if the market crashes?

Yes, property prices are typically lower after a housing market crash. However, it’s uncertain whether prices will continue to decline after a crash.

An increasing number of individuals are considering investing in digital real estate as the sector is evolving. This kind of investment doesn’t require a big down payment or entail the same significant risks as traditional real estate.

Final Bite

A housing market crash can devastate homeowners because it leads to a decrease in property values. In severe cases, a crash may result from an economic downturn or increasing interest rates, making mortgage payments unaffordable.

Predicting when a crash will happen or when the market will bottom out is challenging. Potential homeowners should ensure they do not overextend themselves financially when taking out a mortgage.

Finance

What Is PayPal & How Does it Work?

What is PayPal?

PayPal is a payment platform that lets you send and receive money online or in stores. You can use it on the website or through the app on your phone. To get started, you create an account and link it to your checking account, credit card, or both.

Once your account is set up and your payment method is verified, you can start sending and receiving money. PayPal acts as the middleman, making transactions secure. Many online and offline stores, both big and small, accept PayPal payments.

PayPal also offers credit and debit cards with the PayPal name on them, giving you more ways to use your account.

Key Takeaways

Here are the key points about PayPal:

- PayPal is an online payment platform that helps people and businesses send and receive payments.

- It used to be part of eBay but became its own company in 2015.

- Aside from online payments, PayPal also provides a debit card for purchases, credit card readers for businesses, and lines of credit.

- PayPal is known for being a secure way to send money online.

How Does the PayPal Work?

Here’s how PayPal works:

- PayPal provides payment services for both consumers and merchants. Merchants can use a PayPal card reader in physical stores or add PayPal as a payment option on their websites.

- Consumers can easily pay invoices and transfer money. Cash can be sent to any email address or phone number, even if the recipient doesn’t have a PayPal account. If they don’t have an account, they’ll be prompted to create one after receiving the money.

- To sign up, users need an email address and must link a credit card, debit card, or bank account. Their mobile number will also be verified. This verification ensures that the account is being set up by the rightful owner before it can be used.

- Shoppers can choose PayPal as a payment option when shopping online if the retailer accepts it. Transactions are usually completed within minutes. However, for new sellers or certain transactions, funds may be held for up to 21 days.

- PayPal offers a range of solutions for businesses, including payment portals for online and in-person transactions, business management services, and credit and financing options. Business owners need an email address to create a PayPal business account.

- PayPal aims to make online purchases safer by providing a secure payment method that doesn’t require users to disclose their credit card or bank account numbers to the website or store.

- PayPal generates revenue primarily from fees charged to merchants, rather than consumers. There are no fees for using PayPal to pay for a transaction in your home currency, or for sending cash to a friend or relative in your home currency. However, fees apply to other transactions, such as currency conversions and certain seller transactions.

- PayPal-branded credit and debit cards are free to use but may incur fees for certain transactions, similar to other cards. Interest may also apply to credit card transactions. Other fees apply to less common transactions, like buying and selling cryptocurrencies or receiving charitable donations.

PayPal versus its competitors

PayPal is currently the market leader in online payments, holding a 39.06% market share, followed closely by Stripe at 36.82%. Competitors like Authorize.net and Square Point of Sale trail behind with 5.27% and 4.06% market share respectively as of March 2024.

While market share is important, it doesn’t necessarily indicate superiority. However, it does mean that PayPal and Stripe are more widely used by merchants.

About Stripe

Stripe, headquartered in San Francisco and Dublin, Ireland, is a global payments platform. Stripe Connect, a newer offering, caters to small online businesses looking to expand globally. It enables businesses to accept payments in 135 currencies from various credit cards, with Stripe acting as the intermediary.

A comparison by Forbes suggests that while PayPal and Stripe offer similar services and fees, PayPal may be more user-friendly for small merchants, while Stripe offers greater customization options.

Special Considerations

While PayPal is not a bank, it is still subject to many consumer protection regulations similar to those governing banks. For instance, the level of your liability for an unauthorized transaction depends on how quickly you report the unauthorized activity to PayPal. Promptly notifying PayPal when you have concerns can help minimize your liability. It’s advisable for PayPal users to regularly check their accounts for any unusual activity.

PayPal History

PayPal traces its origins back to the late 1990s when it was launched as a payment system for Palm Pilot users by a software company called Confinity. After merging with X.com, an online banking company, in 2000, the company adopted the name PayPal.

The platform gained popularity as the preferred payment method for eBay transactions, leading eBay to acquire PayPal in 2002 and integrate it as the site’s official payment service. This move helped PayPal expand its user base significantly.

In 2015, PayPal became an independent company through a spin-off and began trading on the Nasdaq under the ticker symbol PYPL.

Over the years, PayPal has grown through acquisitions, acquiring companies that specialize in different aspects of financial transactions, digital money transfers, and payments. One notable acquisition was BrainTree, the owner of Venmo, a rival service, in 2013.

Today, PayPal’s portfolio includes brands such as Xoom, Zettle, Hyperwallet, Honey, Chargehound, Paidy, and Simility, each contributing to its diverse range of financial services and features.

Important: PayPal charges no fees for routine payments, but adds a fee for “instant” transfers.

FAQs

Here are some FAQs about PayPal:

Is PayPal a Good Choice for a Small Business?

PayPal is a major player in the small business payment space, offering easy-to-use services and a range of features to help run a small business. However, its merchant fees can be relatively high compared to some credit card payment services.

Is PayPal a Good Choice for a Consumer?

For online shopping in the U.S., PayPal is often a convenient option at checkout, especially if your card or bank account is already linked to your PayPal account. It can also provide an added layer of security since you don’t have to share your payment information with the seller. PayPal also offers buyer protection in case you don’t receive what you ordered. In the real world, there are many payment apps to choose from, so it’s best to compare and choose the one that suits you best.

Is PayPal Safe to Use?

PayPal uses end-to-end encryption and offers two-factor authentication for added security. It’s considered a safe option for electronic transactions.

The Bottom Line

PayPal is a significant player among the various payment apps available both online and offline.

Basic services like using your checking account for payments and transferring money are free for users. However, fees apply to other services such as currency conversion and instant transfers, which are standard in the industry.

Merchants who use PayPal to accept payments pay transaction fees. In return, they gain access to a range of small business services provided by PayPal.

As the dominant online payment service, PayPal is a popular choice for online transactions. Small business owners should review competitor offerings to determine the best payment app for their needs.

-

Technology1 year ago

Technology1 year agoRise and Fall of Realm Scans: Exploring Paranormal Mysteries

-

Celebrity1 year ago

Celebrity1 year agoMisty Severi – The Breaking News Reporter

-

Technology1 year ago

Technology1 year agoIntegremos, What is it? Complete Information

-

Technology4 months ago

Technology4 months agoStudy Fetch AI: Reviews, Pricing, and Free Alternatives

-

Education1 year ago

Education1 year agoMyOLSD: A Guide to Login, Portals & Resources

-

Business1 year ago

Business1 year agoPaycor Company: Details, Login & Recruitment

-

Business1 year ago

Business1 year agoHow to Recruit New Employees?

-

World1 year ago

World1 year agoTrump Nominated for Nobel Peace Prize Over Abraham Accords